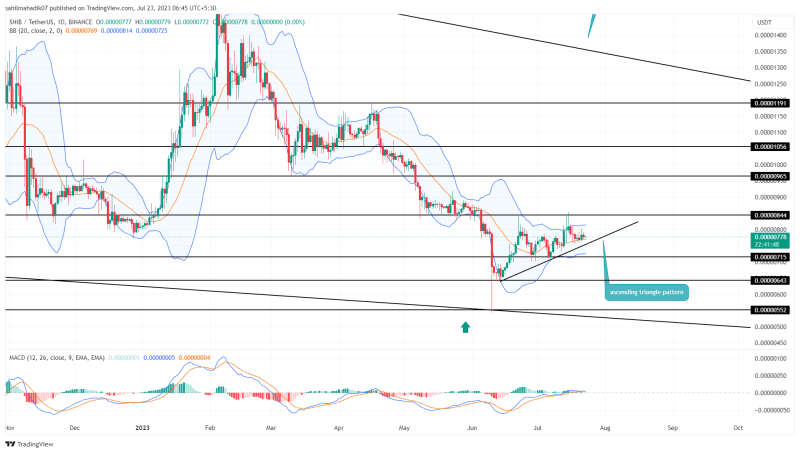

Despite the indecisive market trend, the Shiba Inu price maintains its recovery sentiment under the influence of an ascending triangle pattern. Over the past five weeks, the coin buyers have been receiving dynamic support from the pattern’s rising trendline. From the June 14th low of $0.0000064, the prices have surged 22% to reach the current trading price of $0.0000078. Here’s how this pattern could lead the popular memecoin to even higher price levels.

Also Read: Shiba Inu Claws Back Gains But This Metric Shows Better Days Are Ahead

Shiba Inu Price Daily Chart:

- The narrow range of ascending triangle pattern creates a no-trading zone

- A bullish breakout from $0.00000845 will set the SHIB price for a 25% upswing

- The intraday trading volume of the Shiba Inu coin is $73.2 Million, showing a 26.3% loss.

Source- Tradingview

With an intraday loss of 0.39%, the Shiba Inu price is gradually approaching the lower trendline of the triangle pattern. Amid the market uncertainty, this support could offer buyers a solid footing to attempt another upswing.

The potential reversal could rise 9.35% and challenge the neckline resistance of $0.0000085. This horizontal barrier has already offset the buyer’s attempt at recovery twice and therefore stands as a significant supply zone.

Until this overhead resistance is intact, the SHIB price will continue its sideways action. However, this narrowing range will eventually lead to a breakout opportunity, preferably on the upside. The $0.0000085 breakout will trigger the triangle pattern and intensify the underlying buying pressure.

The post-breakout rally could lead the Shiba Inu price by 25% to hit the $0.0000105 mark.

Is SHIB price Heading Back to $0.00000643?

If market sentiment shows no improvement, the Shiba price would be at risk of breaking the lower trendline. This crackdown would increase the selling pressure and plunge the price 7.8% down to hit $0.00000715 followed by $0.00000643.

- Moving Average Convergence Divergence: Despite a significant rise in the MACD indicator, the SHIB price made a lower low with a late May low, indicating reverse diverging and the possibility of a downtrend continuation.

- Bollinger Band: The narrow range of Bollinger Band indicators suggests a highly volatile market scenario.