BTC price strength marches on despite the curveball CPI print and FTX liquidation go-ahead, and Bitcoin traders are hopeful for long opportunities.

Bitcoin (BTC) hit new September highs after the Sep. 14 daily close as markets digested macroeconomic and crypto industry news.

Trader: Bitcoin market “feels different”

Data from Cointelegraph Markets Pro and TradingView tracked overnight BTC price highs of $26,535 on Bitstamp.

The largest cryptocurrency had shaken off higher-than-expected United States Consumer Price Index (CPI) the day prior, maintaining $26,000.

Subsequent confirmation that defunct exchange FTX had received legal permission to liquidate its remaining assets likewise failed to dent Bitcoin’s comparatively solid intraday performance.

At the time of writing, BTC/USD traded at near $26,300, still up 5.5% versus its September lows.

“Coming up to the range highs and once e flip these levels we can look to finally get into a safe position and long,” popular trader Crypto Tony told subscribers on X (formerly Twitter) on the day.

Fellow trader Daan Crypto Trades suggested that overall Bitcoin market dynamics had changed versus the period of weakness seen around the monthly close.

“Market feels different this week. Dips being bought up relatively quick and while price keeps sweeping highs it keeps crawling itself back and leaving lows untouched,” he wrote.

$BTC.D Still holding on to the previous range high and bouncing.

In the chop region but ultimately I think this would go higher in case of a BTC ETF Approval (one day). pic.twitter.com/3ob4MHl53l

— Daan Crypto Trades (@DaanCrypto) September 13, 2023

More cautious was trader Skew, who referenced on-chain volume primed to cool once more after a “relief rally.”

“Daily structure looks fairly good here & decreasing volume so could definitely be looking towards a relief rally before lower,” part of commentary read, noting that BTC/USD was still holding the key $25,000 level.

First “green” September in seven years?

Up 1.15% month-to-date at the time of writing Bitcoin was nonetheless on course for its best-performing September in years.

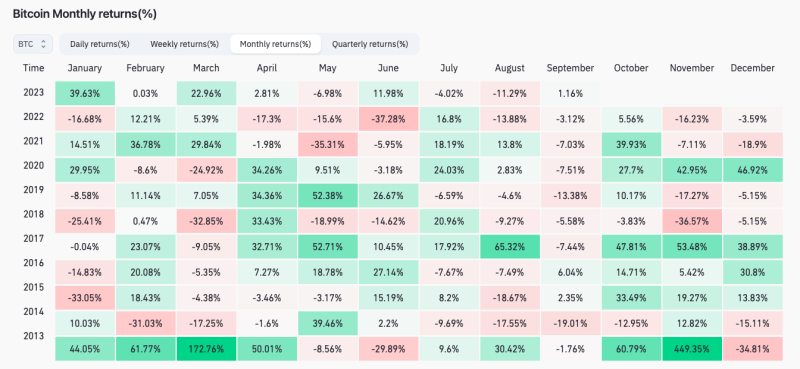

According to data from monitoring resource CoinGlass, the last time that BTC/USD gained in September was in 2016.

That year was its best on record at 6.35%, while its biggest “red” September month two years prior, when it lost 19%.

In 2022, Bitcoin shed 3.1% before climbing another 5.6% in October — a popular month among bulls, who informally refer to it as “Uptober.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.