The $21.28-$22.05 zone served as resistance in August and during the September rally. It was retested as support in recent hours- can the buyers hold on?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- Solana has a bullish higher timeframe structure.

- The volume indicators were not positive in the near term and traders can wait for conditions to change before looking to buy.

Solana [SOL] saw an update to its validator client Solana v1.16 posted on 6 October. The implications and details of this development are explored in detail here. From the price action perspective, Solana has a chance to rally, but its sentiment was bearish in the near term.

Read Solana’s [SOL] Price Prediction 2023-24

The previous technical analysis report of Solana by AMBCrypto published on 5 October noted that $22.5 was an important support. It highlighted an FVG on the 12-hour chart at $22 to draw bulls’ attention to that area where SOL could rebound from.

At press time, SOL was trading just above $22, but the technical indicators showcased short-term bearishness.

SOL has a bearish structure on H4 but the bulls still have hope

While Solana has a bearish structure on the 4-hour chart, it was strongly bullish on the 1-day chart. The move above $20.6 was critical and the bulls were swift to pump prices to $25 ten days ago, a solid signal of bullish intent.

The Fibonacci retracement levels (pale yellow) were plotted based on SOL’s rally from $12.8 to $32.13 that took place in June and July. The 78.6% retracement level of this move was at $16.94, a level that SOL almost tested on 11 September before bounding higher.

The 50% level at $22.47 has been relinquished by the bulls. This was accompanied by a drop in the RSI below neutral 50, and the CMF below -0.05.

Together the indicators underlined bearish momentum and significant capital flow out of the market. The OBV also saw a downturn over the past week, but it was merely a pullback compared to the gains it made in late September.

Bullish sentiment trickles into the futures market but the spot market wasn’t hopeful of a rally

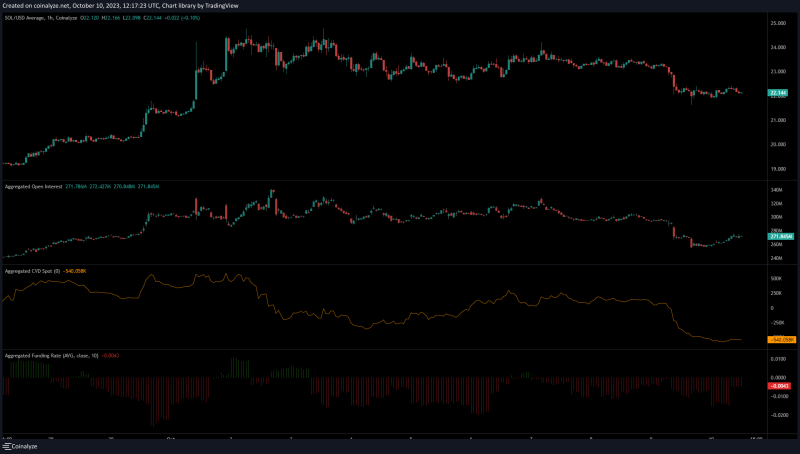

The funding rate was negative for a good chunk of October as traders expected SOL to retrace its massive rally in September. The past two days saw both the price and the Open Interest slide lower and indicated bearish sentiment.

How much are 1, 10, or 100 SOL worth today?

The spot CVD was unwilling to jump higher and was a sign that demand for Solana wasn’t yet overwhelming. Short-term traders can wait for these conditions to change before looking to buy.

The $21.28-$22.05 zone had served as resistance in August and during the September rally. It was retested as support in recent hours. Therefore, it was likely to see a SOL rally initiated soon. Hence bulls can look to long the token but risk management would be vital.