As the Ethereum price plunged $below 2,300, Celsius moved $40 million worth of ETH to Coinbase amid bankruptcy liquidation. By Coingape Staff 21 mins ago

Celsius Network, a bankrupt crypto lender, has been on a sell-off spree as it is liquidating its crypto assets to repay its creditors. Most of the sell-off circles around Ethereum (ETH) as it constitutes a majority of Celsius’ reserves. In the latest development, the crypto lender transferred over $40 million worth of ETH to Coinbase, a leading crypto exchange.

Celsius Transfers Massive ETH Reserve To Coinbase

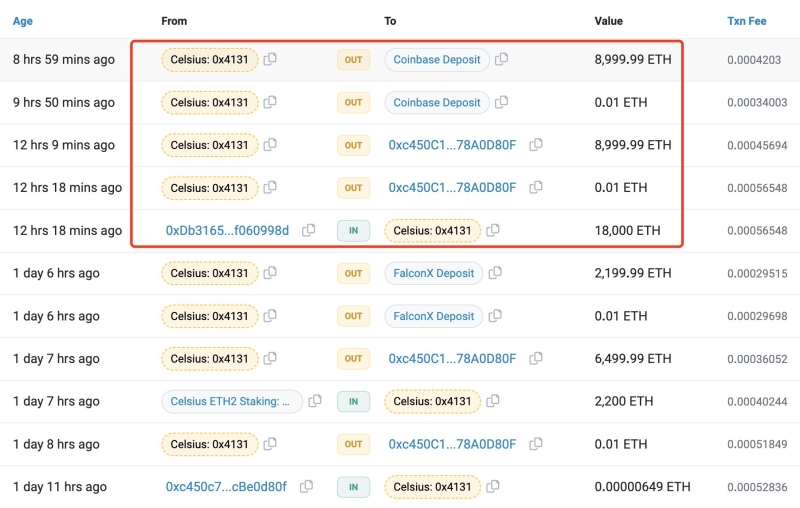

According to data from Lookonchain, an on-chain tracking platform, Celsius recently moved 18,000 ETH tokens from their reserves to Coinbase. The transaction accounted for nearly $40 million worth of ETH being transferred, considering the current ETH price trend.

Celsius Transfers 18k ETH To Coinbase, Source: Lookonchain | X

Furthermore, as the Celsius ETH unstaking program progresses, it has been reported that since November 13, 2023, the institution has deposited a total of $280,760 ETH tokens to Coinbase, FalconX, and OKX exchanges. This accounts for a massive $621 million worth of Celsius ETH reserves being unstaked.

Whilst, Celsius currently holds an Ethereum reserve of 540,029 tokens, valued at over $1.2 billion. Earlier, on Monday, Celsius recorded a deposit of 13,000 ETH worth $30.34 million to Coinbase. Moreover, another transaction noted a shift of 2,200 ETH, equivalent to $5.13 million, to FalconX.

In addition, last week, the bankrupt crypto lending firm transferred 34.8 million Polygon (MATIC) tokens to Binance, the world’s largest crypto exchange. The transaction was valued at $26 million at the time. Moreover, FTX joined in with a significant transfer of ETH and Wrapped Bitcoin (WBTC) to Wintermute and Binance.

Best Crypto Exchanges and Apps September 2024 Must Read Top Meme Coins to Buy Now: What You Need to Know Must Read Top 10 Web3 Games To Explore In 2024; Here List Must Read

Ethereum Price Falls To $2,200 Range

The Ethereum price has dropped below $2,300, which is spurred by the overall bearish sentiment in the market. However, the ETH price showed signs of a rebound as it gained 0.43% and traded at $2,239.26 at press time on Wednesday, January 24. The second-largest crypto displayed a market valuation of $269.07 billion.

Whilst, the trading volume for Ethereum dropped 1.32% to $14.40 billion in the past 24 hours. During the day, the ETH price extended as low as $2,167.28 before surpassing the $2,200 level again. Moreover, it’s important to note that ETH has lost over 54% from its ATH of $4,891.70 two years ago.

In addition, the crypto has plunged more than 17% from its high of $2,710.42 attained in the week the Spot Bitcoin ETFs were approved. According to TradingView data, ETH is boasting a strong bearish outlook in the short term, considering the EMA values. Currently, ETH is trading fairly lower than the 10-day and 50-day EMAs of 2380.3 and 2316.1, respectively.