Renowned analyst Benjamin Cowen draws parallels to late 2020, pointing to a potential liquidity shift from altcoins.

Edited By: Jacob Thomas

- Market analysts suggested that Bitcoin may outpace altcoins as the BTC/ALT ratio reached historical levels.

- Bitcoin also reached a new all-time high as exchange reserves continued to decline.

Over the past month, Bitcoin [BTC] has been the focal point of market activity, attracting both retail and institutional investors. This interest has driven a 34.16% price surge within a month.

In the past 24 hours, BTC has gained an additional 1.06%, hitting a record price of $94,002.87, at press time.

AMBCrypto’s analysis pointed out that emerging market trends and data indicate Bitcoin could be on the verge of another significant upswing.

Analyst predicts potential upside for BTC

Popular crypto analyst Benjamin Cowen highlighted a critical moment for BTC, suggesting that Bitcoin may be on the verge of another significant rally.

According to Cowen, the ALT/BTC pair reached a valuation similar to its level on the 24th of November 2020, just before a major shift in liquidity from altcoins to BTC.

Historical data shows that in 2020, this liquidity divergence propelled Bitcoin to new highs over five weeks, while altcoins largely stagnated.

Cowen notes the parallels, stating,

“The ALT/BTC pairs are at the same valuation today as they were in November 2020, right before the final drop of ALT/BTC pairs began.”

If the pattern repeats, BTC could see a meteoric rise, establishing new highs as altcoins take a back seat during the anticipated shift.

Stablecoin minting could signal inflows to BTC

Recent data showed a significant rise in stablecoin minting, with a total market capitalization of USDT now reaching $128.90 billion, which is often a bullish signal for the broader crypto market.

In a notable development, Tether [USDT] recently minted one billion USDT on the Ethereum blockchain.

Such large-scale minting typically reflects growing demand and is typically used to acquire other cryptocurrencies by market participants.

Given the recent ALT/BTC pattern, it’s likely that a significant portion of this newly minted USDT will flow into Bitcoin if history repeats itself.

Falling exchange reserves point to market shift

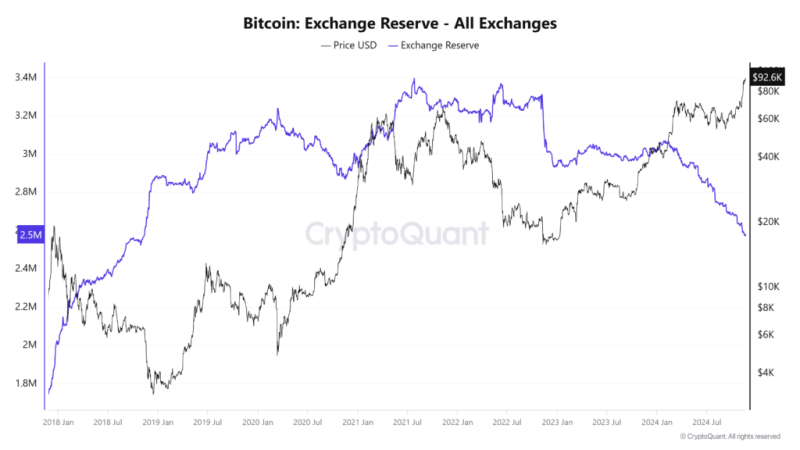

Data from CryptoQuant revealed a notable decline in Bitcoin exchange reserves, with daily and weekly figures showing decreases of 0.34% and 0.77%, respectively.

As of this writing, the total Bitcoin reserve on exchanges has dropped to 2,572,477.995 BTC, marking its lowest level since 2019.

A consistent decline in available BTC on exchanges is often considered a bullish indicator, as it suggests market participants are opting to hold their Bitcoin in private wallets rather than selling.

This shift reflects growing confidence in Bitcoin’s long-term value.