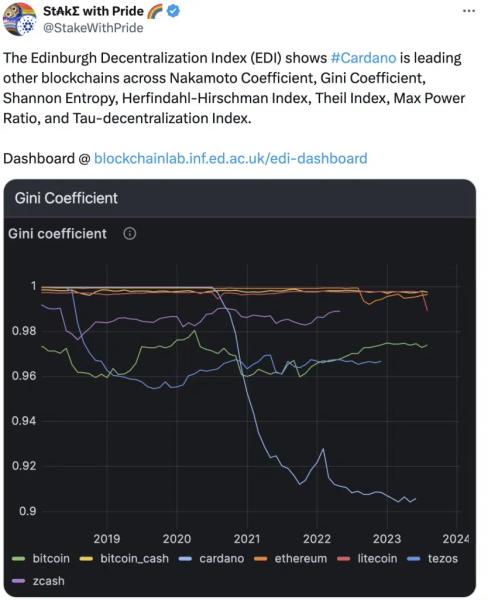

Cardano leads in decentralization metrics per Edinburgh Decentralization Index.

Edited By: Ann Maria Shibu

- Cardano exceled in Nakamoto Coefficient, Gini Coefficient, and few other metrics.

- Despite decentralization achievements, Cardano faced declining network activity.

Cardano [ADA] charted a distinctive course in recent days, deviating from the price trends observed in other altcoins. While its price trajectory may not mirror its counterparts, Cardano exceled in various decentralization indices.

Cardano remains decentralized

According to data from the Edinburgh Decentralization Index (EDI), the Cardano network showcased leadership in Nakamoto Coefficient, Gini Coefficient, Shannon Entropy, Herfindahl-Hirschman Index, Theil Index, Max Power Ratio, and Tau-decentralization Index.

These metrics reflect a diverse mining landscape and equitable distribution of ADA. Moreover, they also showcase that Cardano has a diverse node structure and a balanced stake concentration.

Cardano ranking high in these areas shows how unlikely it is that the concentration of power may be given to large stakeholders.

However, the Cardano network continued to face challenges, marked by a decline in overall activity. Network activity dwindled from 72,000 to 45,000 over the past few months, raising concerns about diminishing user engagement and potential negative implications for Cardano’s vitality.

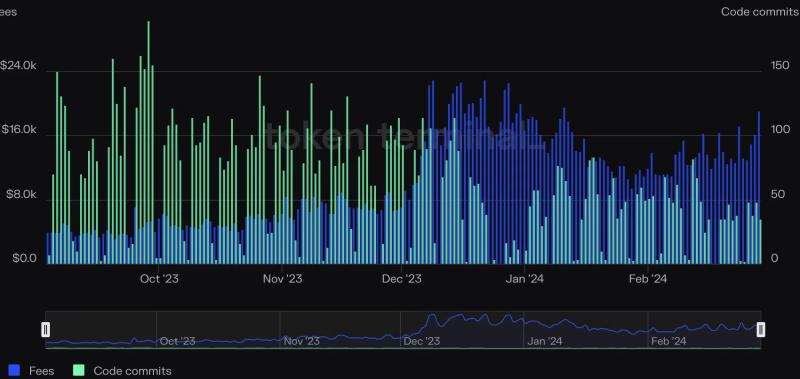

On a positive note, the network’s fee generation witnessed an 11% surge, reflecting increased transactional activity and potential financial benefits This surge in fees is indicative of a thriving ecosystem, poised for sustained growth.

Development activity on Cardano was another area where the blockchain saw growth. The number of code commits surged by 13.4% in the past week, showcasing a commitment to ongoing improvements and innovations within the ecosystem.

Looking at ADA

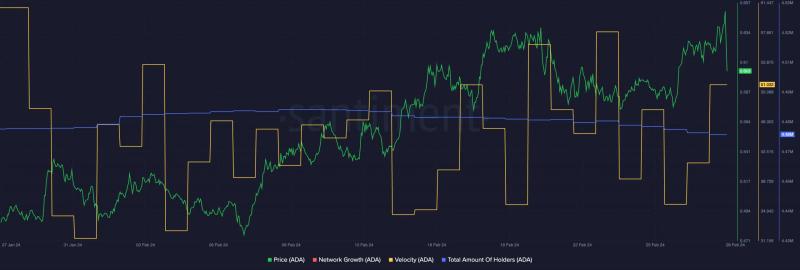

Despite these positive indicators, ADA experienced a 2.28% decline in price within the last 24 hours, signaling short-term volatility. Additionally, the volume plunged by 32.66% during the same period, reflecting potential shifts in market sentiment.

How much are 1,10,100 ADAs worth today

The overall velocity of ADA, a metric reflecting the frequency of ADA transactions, witnessed a significant decline in recent days. This dip in velocity suggests a potential decrease in trading frequency, impacting the coin’s liquidity and market dynamics.

Moreover, the number of ADA holders had also declined, showcasing a larger trend of holders losing interest in the ADA token. There would need to be a massive shift in trader sentiment for ADA to see the same level of growth as its crypto counterparts.

Source: Santiment