Dogecoin whales moved DOGE worth billions of dollars as the memecoin’s price action turned bearish.

Edited By: Ann Maria Shibu

- DOGE’s price dropped by more than 5% in the last 24 hours.

- A few metrics and technical indicators hinted at a trend reversal soon.

The spotlight once again shifted to Dogecoin [DOGE], as the memecoin witnessed a massive rise in transactions. While that happened, the memecoin’s price action turned bearish. Let’s have a closer look at what’s going on with Dogecoin.

Dogecoin whales are gearing up

Coinpedia Market recently posted a tweet highlighting an interesting development around Dogecoin.

As per the tweet, the memecoin experienced a surge in large transactions amidst Ethereum ETF speculations. The total value of DOGE’s large transactions exceeded $100,000, increasing from $1.53 billion to $3.01 billion in the last 24 hours alone.

The tweet also mentioned that this surge indicated a significant increase in the volume of DOGE being moved by whales, as the number went up from 9.74 billion to 17.97 billion coins.

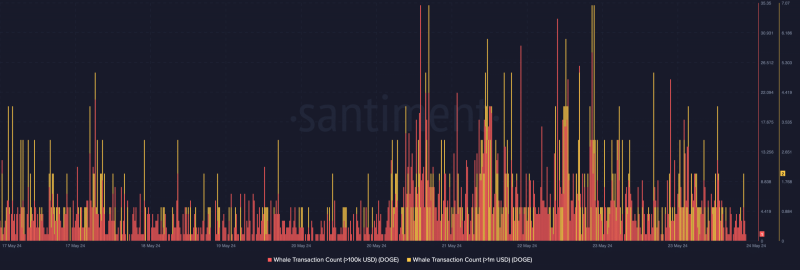

AMBCrypto’s analysis of Santiment’s data also painted a similar picture. As per our analysis, the number of whale transactions increased sharply over the last few days.

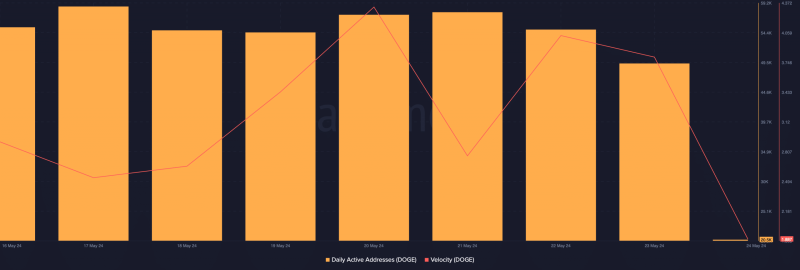

Not only whales, but network activity in general, remained high last week. The memecoin’s daily active addresses were stable throughout the last week.

Additionally, its velocity was also up, meaning that DOGE was used more often in transactions within a set timeframe.

Bears make an entry

While Dogecoin whales moved a large number of coins, bears took over as the memecoin’s price dropped.

According to CoinMarketCap, DOGE was down by more than 5% in the last 24 hours. At the time of writing, Dogecoin was trading at $0.1578 with a market capitalization of over $22.7 billion.

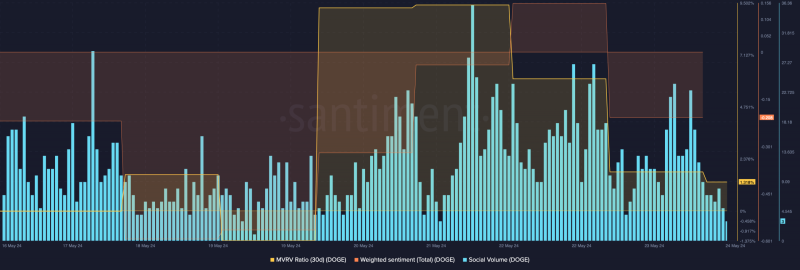

The recent drop in price also had a negative impact on its social metrics. For instance, its social volume dropped after peaking on the 21st of May.

Its weighted sentiment also declined, meaning that bearish sentiment around the memecoin was dominant in the market. Another bearish metric was the MVRV ratio, which plummeted in the last few days.

However, the bearish trend might not last long. At press time, DOGE’s fear and greed index had a value of 37, meaning that the market was in a “fear” phase. Whenever the metric hits this level, it indicates that the chances of a trend reversal are high.

To see whether a trend reversal is likely, AMBCrypto analyzed DOGE’s daily chart. We found that the Money Flow Index (MFI) registered an uptick.

DOGE’s price was sitting at its support near its 20-day Simple Moving Average (SMA).

If it tests that support, then investors might witness a rebound. However, the Chaikin Money Flow (CMF) looked bearish, hinting at a continued price decline.