PEPE’s official Twitter handle posted a tweet revealing the reason behind the memecoin’s recent downfall. Whales used the opportunity to increase accumulation.

- PEPEs worth millions were stolen and sent to exchanges on 24 August.

- Whale accumulation increased, and PEPE’s price surged by 3% in the last 24 hours.

Pepe [PEPE] recently witnessed a massive dump, causing its price to tumble and sparking fear among investors. The memecoin’s official Twitter handle posted a tweet on 26 August, shedding light on the entire episode and mentioning the actual reason for the sell-offs.

Moreover, as reported earlier, while most investors dumped, a few whales took the opportunity to buy more.

Here is what happened to PEPE

As per the official tweet, there were a series of unexpected transactions that took place from the PEPE multi-sig CEX on 24 August, which was the primary reason for the dump.

Wallets in which nearly 16 trillion tokens were transferred to various crypto exchanges, and the required signer count was reduced to 2/8 wallets.

an announcement to the $PEPE community:

Yesterday on August 24th, 2023, a series of unexpected transactions took place from the $PEPE multisig CEX

Wallet in which ~16 Trillion $PEPE tokens (worth roughly $15m USD) were transferred to various crypto exchanges (OKX, Binance,… pic.twitter.com/iZmXV1TAvw— Pepe (@pepecoineth) August 26, 2023

Three former team members stole millions of dollars’ worth of tokens and sent them to exchanges for sale. Afterward, they deleted all of their social media accounts after removing themselves from the multi-sig in an effort to disassociate themselves from PEPE.

The episode turned out to be disastrous for the memecoin, as its price fell by 20% on 25 August 2023. However, things were starting to get better.

PEPE on a path to recovery

The good news was that after the bloodbath, PEPE’s price managed to stabilize. In fact, the memecoin was up by nearly 3% in the last 24 hours. At the time of writing, it was trading at $0.0000009011 with a market capitalization of over $353 million.

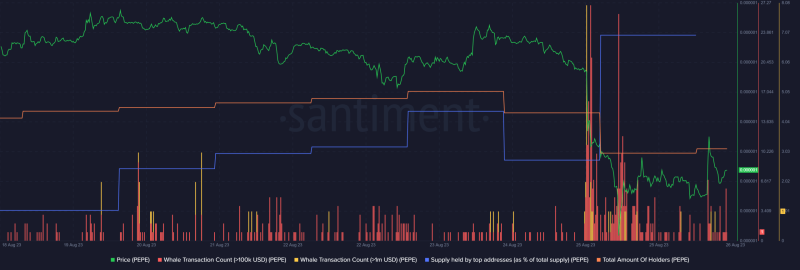

It was interesting to note that whale activity around the coin surged drastically during the price plummet. This happened while the supply held by top addresses increased.

The incident clearly meant that whales tapped the opportunity to accumulate more, as they expected the memecoin to rise again. However, the general market’s confidence in PEPE was low, as its total number of holders declined during that time.

Though the metrics looked bullish, a look at the memecoin’s daily chart painted a vague picture. For instance, the Relative Strength Index (RSI) registered a slight uptick from the oversold zone – a bullish signal. However, the memecoin’s Money Flow Index (MFI) went southward.

Additionally, its Chaikin Money Flow (CMF) also took a sideways path. Considering the aforementioned market indicators, only time will tell where PEPE moves in the days to come.