Contents

StakeWise review

As you may know, Ethereum 2.0 staking is already underway, and users are being rewarded for locking their ETH into the Eth2 staking contract.

Unfortunately, it’s pretty technical for users to manage Ethereum staking by themselves, and node downtimes and the associated possible penalties are not something that a majority of users want to deal with. Additionally, locking up ETH into the Eth2 staking contract directly removes the user’s ability to use the staked ETH during the current DeFi bull run.

For users who want to benefit from ETH staking but would still like to enjoy more convenience, there are staking-as-a-service (SaaS) platforms which address many of the problems mentioned above. In this review, we’ll be taking a look at StakeWise.

The basics

StakeWise provides an extremely easy method for users to take part in the Eth2 staking contract. It provides an intuitive platform to allow users to deposit ETH and earn rewards for staking Ether.

The main goal for StakeWise is to fully meet all ETH staking needs for its users at a competitive price point. Additionally, they have ensured that using the platform requires no special technical knowledge from the user.

So far, there is a total of 17,216 ETH, worth around $32 million, already deposited into StakeWise.

Stability is a top priority

One of the major advantage points for StakeWise is its ability to provide a service that achieves the highest possible yield for users on the platform.

To achieve this, their service is run on a stable banking-grade cloud infrastructure to ensure the validator is never penalized and, therefore, providing the highest yield possible. Their setup allows for zero-downtime upgrades and multi-node clusters, meaning that anytime they need to upgrade their servers, there is no downtime in between. This is all done to avoid penalties and should therefore lead to the highest staking return possible.

Their service also scales according to the demand present on the platform. When the beacon Chain uses more RAM, a migration occurs to more powerful servers automatically, and their zero-downtime upgrade ensures there are no penalties in the process for stakers.

A variety of staking options

StakeWise provides a variety of different staking options to choose from. You can either choose to stake inside a pool or stake privately.

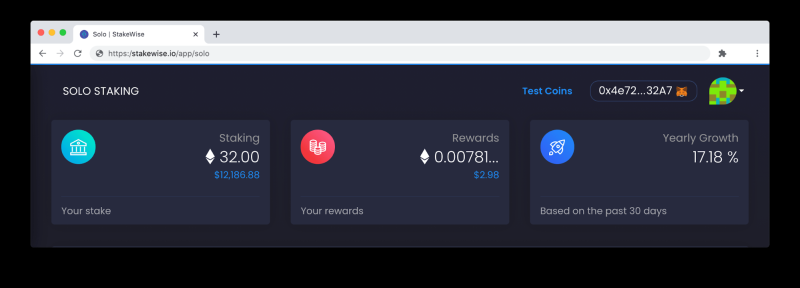

Both of these options have real time monitoring statistics, so you can instantly see how much you are earning.

To stake in their staking pool, you just need a deposit of 0.001 ETH to start with. There is also a one-month lockup period when you deposit into the pool itself.

In addition to this, there is also a feature called private-pools which are invite only. This allows you and a group of friends to pool your ETH together and stake as one in a private pool.

Their other option is to stake alone in the Eth2 contract. This requires the typical 32 ETH deposit that is required for all individual stakers. Their platform provides you with full control of your stake and providers you with a withdrawal key and validator exit so you can remove your stake at any time if you wish to do so.

As mentioned, StakeWise aims to provide this service at a very competitive rate. Currently, they are charging a 10% commission on rewards from the pools.

Liquid staking through tokenization

One of the main selling points for StakeWise is that it offers liquid staking, which allows users to continue to use their locked ETH in DEFi. Typically, when you deposit your ETH into Eth2 staking, your ETH funds are totally locked up, preventing you from using the assets for anything else, such as investing in DeFi.

As a solution, StakeWise introduced two tokens for depositors to allow them to use in DeFi while their ETH are used for staking. sETH2 (staking ETH) and rETH2 (reward ETH) are tokens that are issued to stakers in the StakeWise pools.

These two tokens are ERC-20 tokens and can be used in trading, utilizing yield opportunities in DeFi protocols, and can be transferred. They represent the ownership of a user that has deposited ETH into the platform.

The sETH2 token is backed on a 1:1 ratio for ETH and is only minted when a user deposits ETH into the StakeWise pool.

Governance through the SWISE token

In early March 2021, the protocol raised $2 million in a private fundraising event to release its governance token SWISE. In the private sale, Greenfield was one of the main investors, alongside Collider Ventures, Gumi Cryptos, and Lionchain Capital.

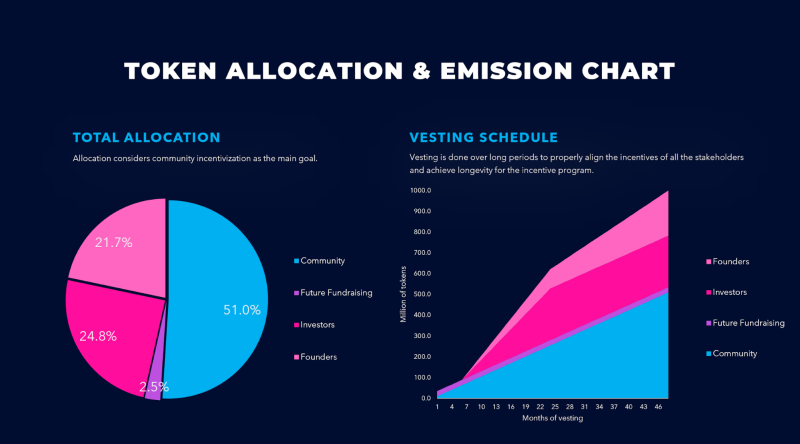

The launch of the token now brings an entirely new DAO Governance protocol to the entire platform, putting the direction of StakeWise into the hands of the users. In total, there are 1 billion SWISE tokens that will be released according to the following tokenomics model:

Members of the StakeWise DAO will have the responsibility for important parameters on the platform. For example, they will be able to set the fees paid by stakers, change the commissions paid to node operators, and onboard different oracles and node operators according to the votes.

In addition to this, they will also be the principles of liquidity mining campaigns, be able to whitelist gauge contracts, and approve contract changes for the introduction of new features on the StakeWise platform itself.

Security

Lastly, it is important to mention that StakeWise has implemented multiple security features. Their banking grade infrastructure has already been mentioned, and this provides users with the security of knowing that they are very unlikely to face any downtime penalties with staking through StakeWise – giving them the confidence they will be earning the maximum returns without having the responsibility of operating the nodes.

In addition to this, StakeWise has also had their smart contracts audited to ensure that their code is safe from bugs. Runtime Verification conducted their audit in December 2020 and the results from the audit can be viewed here.

The bottom line

The staking service offered by StakeWise has been thought through carefully. They ensure that there are no downtime penalties meaning its users earn the highest rewards possible. In addition to this, they make the entire process extremely easy and provide a method to remain relatively liquid even while locking ETH into the contract.