Contents

The cryptocurrency exchange market is highly competitive, and there’s an entire spectrum of exchanges available to crypto investors today. Some exchanges offer a lot of fancy features, but might be operating from a jurisdiction where cryptocurrency trading platforms are only regulated loosely. Other exchanges stick to a more conservative approach and try to win over customers by providing a transparent and regulated service.

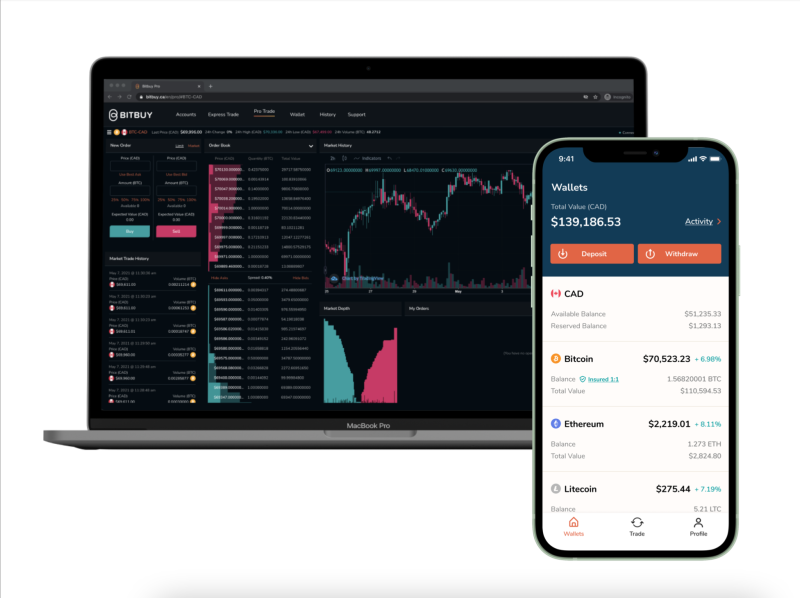

In this article, we’ll be taking a look at Bitbuy, a Canada-based cryptocurrency exchange that’s geared towards Canadian cryptocurrency investors. Bitbuy provides an intuitive onboarding experience for novice cryptocurrency investors, but the exchange also caters to more advanced users through its Pro Trade platform and API connectivity. Clients who want to invest larger amounts can leverage Bitbuy’s OTC desk, which is designed to facilitate investments worth $50,000 and above.

Bitbuy was established in 2016 and the company is registered with Canada’s financial intelligence agency FINTRAC as a Money Service Business (MSB). As a regulated exchange, customers are required to verify their identity through a know your customer (KYC) process before buying and selling cryptocurrency on the exchange.

Before we take a closer look at the most important aspects of Bitbuy, let’s quickly run through some of the exchange’s main advantages and disadvantages.

Bitbuy Pros:

- Transparency and regulatory compliance

- Grade A security measures in place, including regular proof-of-reserve audits

- Fiat-to-crypto markets

- BTC held by the users on Bitbuy are insured at no extra cost

- Caters to both beginners (Express Trade feature) and advanced users (Pro Trade feature)

- Comprehensive customer support center

Bitbuy Cons:

- Relatively small selection of listed cryptocurrencies, though we’re told more coins are coming in 2021

- Only available in Canada

Bitbuy features review

Express Trade

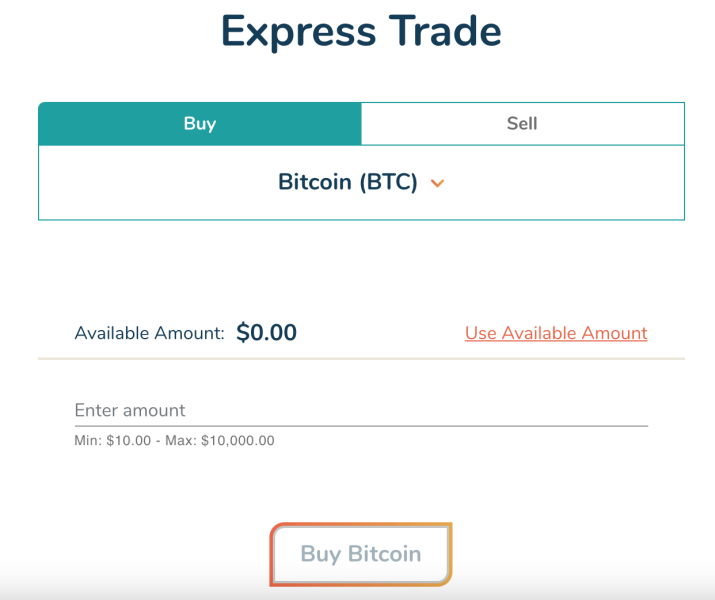

As the name implies, Express Trade is a feature that allows users to buy or sell cryptocurrency with CAD as conveniently and quickly as possible. With Express Trade, users are essentially submitting a market order with Bitbuy and having the order filled at the best currently available price. Trades made via the Express Trade service come with a 0.2% fee (for both buying and selling).

Before clickling “Buy” or “Sell” with Express Trade, you’ll see exactly how much you’re getting and paying. Bitbuy prides itself in being entirely transparent about its fee model. Express Trade is primarily suitable for novices, or users who are looking to make quick buys/sells with smaller amounts. For users that want more flexibility, Bitbuy offers Pro Trade, which is a fully-featured cryptocurrency exchange platform.

Pro Trade and API connectivity

Bitbuy’s Pro Trade platform is designed for more advanced traders and users who want to realize a more complex cryptocurrency investment strategy. All cryptocurrencies on Pro Trade have separate trading pairs against CAD and BTC.

With Bitbuy Pro Trade, users can set up limit orders that are triggered when the selected trading pair reaches a specified price. The Trade Pro interface also displays real-time information about the order book and the bid/ask spread, providing valuable insights into the market.

Pro Trade features price charts powered by TradingView, which is a widely adopted platform among (cryptocurrency) traders – many users will feel right at home with the chart customization tools and indicators available on Pro Trade.

Bitbuy also offers an API that can be used to connect to the exchange’s markets. This option can be leveraged by anyone who requires the ability to automate their cryptocurrency trading.

Supported cryptocurrencies

At the time of writing, Bitbuy supports 7 different cryptocurrencies. The list of supported assets consists of well-established cryptocurrencies with a significant market capitalization:

- Bitcoin (BTC)

- Ethereum (ETH)

- Ripple (XRP)

- Litecoin (LTC)

- EOS (EOS)

- Bitcoin Cash (BCH)

- Stellar (XLM)

While this list will suffice for many cryptocurrency investors, those who are looking to invest in smaller altcoins, or even other prominent cryptocurrencies like Cardano and Filecoin, will have to look elsewhere. The diversity of the cryptocurrencies available for trading is definitely an area where Bitbuy can make improvements.

However, Bitbuy appears to be listening to customer feedback, and says it is looking to list as many cryptocurrencies as possible this year. The exchange says it will be listing two new crypto assets in the coming weeks – Chainlink (LINK) and Aave (AAVE).

Account funding and fees

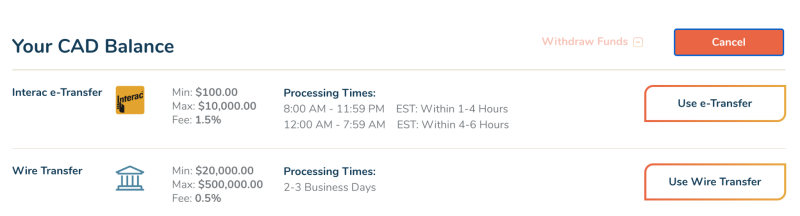

For depositing CAD, accounts on Bitbuy can be funded via a bank wires or Interac e-Transfers. Otherwise, users can deposit any of the 7 cryptocurrencies that are listed on the exchange. The vast majority of users will be opting for the Interac e-Transfer option, since it has a low minimum of $100 and transactions are mostly processed within 15 minutes but can take up to 1 to 6 hours depending on the time of day. Bank wires are meant for larger transfers, as the minimum is set at $20,000.

Buying and selling cryptocurrency via the Express trade feature comes with a 0.2% fee for both buying and selling on Pro Trade, the maker fee is set at 0.1% and the taker fee is set at 0.2%. Overall, Bitbuy’s fees are competitive with comparable cryptocurrency exchanges.

For a more comprehensive overview of Bitbuy’s fees, you can check out the fee schedule on their official website.

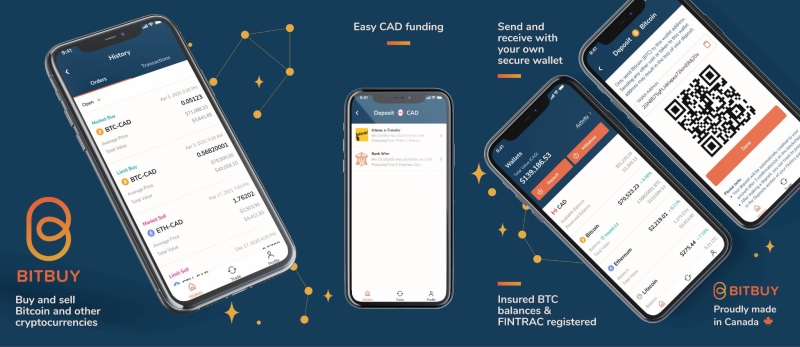

Mobile app

Bitbuy has released its own mobile app that is available on both iOS and Android. The mobile app offers most of the functionality of the desktop version of Bitbuy – for example, you can use the mobile app to buy crypto via Express Trade, and access your trading history, crypto wallet, and more. A mobile app is a must-have for any modern cryptocurrency exchange, and Bitbuy has done a good job of delivering on this front, allowing its users to trade on the go.

Is Bitbuy a safe exchange?

Bitbuy has implemented a series of measures to help protect both deposited cryptocurrencies as well as customers’ accounts. The servers that Bitbuy runs on use multiple cloud service providers that adhere to FIPS 140-2 and other key standards.

The exchange also undergoes regular proof-of-reserve audits to show that they hold the necessary amount of cryptocurrency to cover their obligations towards all customers. Here’s an example of Bitbuy’s proof-of-reserve report for 2020.

This is especially notable since Bitbuy operates in Canada, where the local cryptocurrency community was damaged by QuadrigaCX, a cryptocurrency exchange that was misusing its customers’ cryptocurrency deposits.

Bitbuy is also the only cryptocurrency exchange in Canada to have its BTC holdings insured on a 1:1 basis. This is made possible through a partnership with Bitcoin security firm Knox, which provides custody services for the exchange’s Bitcoin holdings.

Users can protect their accounts by setting up two-factor authentication that is required for logging in or making trades. This can go a long way towards protecting a user’s account in the event that their password is compromised.

The bottom line

Bitbuy is an exchange that’s suitable for new investors that are looking to make their first cryptocurrency investments, and traders that are primarily interested in the biggest cryptocurrencies like Bitcoin, Ethereum and XRP. Bitbuy offers a regulated platform with solid transparency, and impressive security measures like the 1:1 insurance on users’ Bitcoin holdings.

If you live in Canada and are looking for a reliable cryptocurrency exchange, Bitbuy is definitely worth checking out. However, traders who are interested in using leverage or trading exotic altcoins might not find what they’re looking for at present times.

Want to give Bitbuy a try? Sign up now.