In the recent recuperative wave in the crypto market, the SOL price exhibited a pivotal bullish turn from $17.45 on September 11. This upward tilt propelled the cryptocurrency to an impressive 15% appreciation within a fortnight. Adding to this bullish narrative, the SOL price trajectory successfully breaches the upper trendline of a wedge pattern, indicating the buyers are likely to drive a prolonged recovery.

Also Read: Injective Launches Solana and Cosmos Compatible EVM

Will SOL Price Reclaim $20 Mark?

- A bullish breakout from the wedge pattern set a quick 11% Jump

- The coin price below the daily EMAs(50, 100, and 200) reflects the overall downtrend inactive

- The 24-hour trading volume on the Solana coin is $255.4 Million, indicating a 17% gain.

Source-Tradingview

Over the past two months, the Solana price witnessed a steady correction under the influence of a falling wedge pattern. During this downfall, the price resonated between two converging trend lines which indicates the weakening of the underlying bearish momentum.

By the present time, the tenth largest cryptocurrency price trades at the $20 mark, with an intraday gain of 1.83%. Should the prevailing bullish undercurrent maintain its course, potential trajectories suggest an ascent of approximately 12%, targeting the $22.2 mark, and further up by $25.4.

Yet, the daily chart casts a shadow by hinting at pronounced resistance around the current $20 area. This rejection hints at a possible pullback wherein the coin might seek to affirm the recently transcended resistance as a newfound bedrock. For the projected uptrend to be deemed authentic, the SOL price needs to firmly establish its footing above this reclaimed support level.

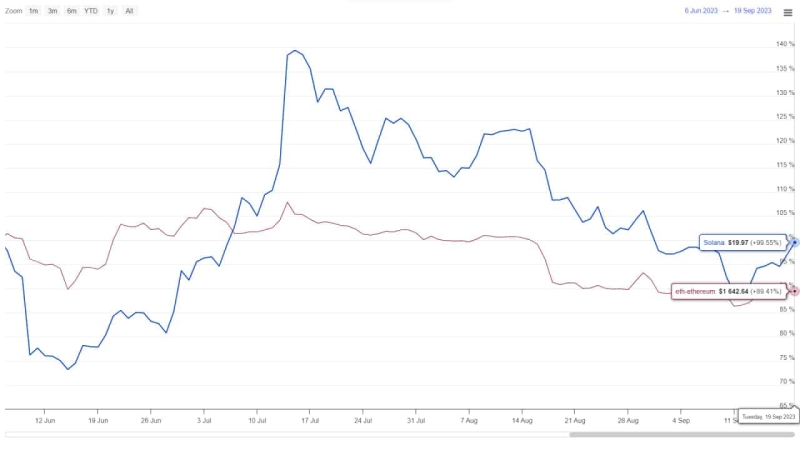

SOL vs ETH Performance

Source: Coingape| Solana Vs Ethereum Price

A look at the last three months’ price action indicates the SOL price has comparatively witnessed a steep correction since July 15. The formation of lower highs and lower lows indicates the sellers are currently dominating this asset. In contrast, the Ethereum price shows a nearly sideways trend, indicating an indecisive nature among traders

- Vortex Indicator: A positive crossover between the VI+(blue) and VI-(orange) slope indicates the increasing bullish momentum among market participants.

- Exponential Moving Average: The coin price surpassing the 20-day EMA after a month provides an added advantage to the market’s buyers.