SHIB could rebound from a key demand zone but further upside depend on BTC not making more losses.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- SHIB retreated to a crucial demand zone at press time.

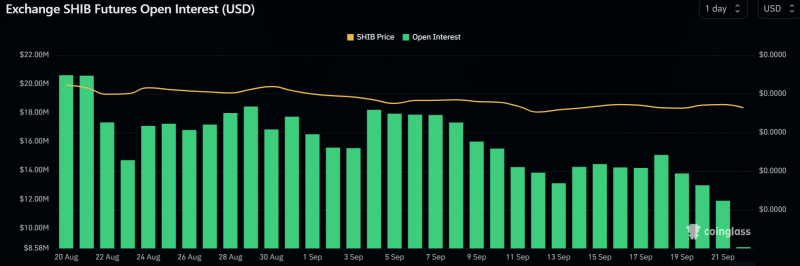

- Demand in the Futures market dipped in September.

As Q3 2023 inches closer to an end, the memecoin segment could close the quarter in the red. In particular, Shiba Inu [SHIB] extended its losses below the December 2022 low ($0.00000779) and has yet to reclaim it.

Despite the recovery seen in September, SHIB sellers still managed to tuck in some gains. At press time, sellers had made an extra 4% after pushing SHIB to $0.00000722, up from a recent high of $0.00000754.

Can late sellers benefit?

SHIB retraced to the key demand zone and H12 bullish order block (OB) of $0.00000713 – $0.00000727 (cyan). Although breached around 11 September during a slight deviation, the demand zone has been defended several times.

So, SHIB could attempt a rebound at the zone and target the immediate resistance levels at $0.00000739 and dynamic 50-EMA (Exponential Moving Average).

However, Bitcoin [BTC] struggles at $27k could complicate matters for bulls and favor sellers. If so, a price rejection could be likely at the immediate resistance levels.

Such a scenario could present two possible shorting opportunities. Both could have the demand zone as a profit target. Entry positions could be placed at $0.00000750 or $0.00000739.

However, the H4 candlestick session closes above $0.00000760, and $0.00000742 will invalidate the short set-ups.

Nevertheless, the wavering Spot demand could limit buyers’ leverage, as illustrated by OBV’s sideways movement. Besides, the negative RSI cemented the above bearish bias.

Demand declined in September

The declining Open Interest rates in September further confirmed the bearish inclination. In addition, liquidation data showed more long positions were rekt within one and four hours before press time.

Nevertheless, the derivative volume was up +100% at the time of writing and calls for close tracking of BTC price movement for optimized set-ups.