Ripple lawsuit: Lawyer Bill Morgan highlights Judge Torres’ ruling in the ongoing SEC battle that XRP is not a security, emphasizing its influence on the FIT 21 bill. By Rupam Roy 3 hours ago

Highlights

- Bill Morgan highlights Judge Torres’ ruling that XRP is not inherently a security.

- The FIT 21 bill aligns with Torres’ decision, reinforcing XRP’s non-security status.

- The bill’s provision states digital assets sold under contracts aren’t securities by default.

A recent comment from the pro-XRP lawyer, Bill Morgan has intensified discussions over the ongoing legal between between Ripple and the U.S. Securities and Exchange Commission (SEC). Recently, the Ripple lawsuit took a new turn as the SEC filed its reply opposing Ripple’s claim to seal and redact evidence to remedies-related briefs and documents.

However, the recent comment from Bill Morgan comes in regard to Judge Torres’s ruling regarding the XRP’s security status.

Judge Torres’ Ruling and Its Impact on FIT 21

The FIT 21 bill has gained traction in the crypto community as a potential framework to provide regulatory clarity for digital assets. The U.S. House of Representatives recently voted on this landmark bipartisan crypto bill, marking a significant step towards establishing a clear regulatory environment for digital assets.

However, amid this, pro-XRP lawyer Bill Morgan highlighted Judge Torres’ influence on the bill, particularly her ruling that XRP is not inherently a security. The XRP lawyer shared an image on the X platform, stating, “The Torres influence on FIT21. XRP is not itself a security.”

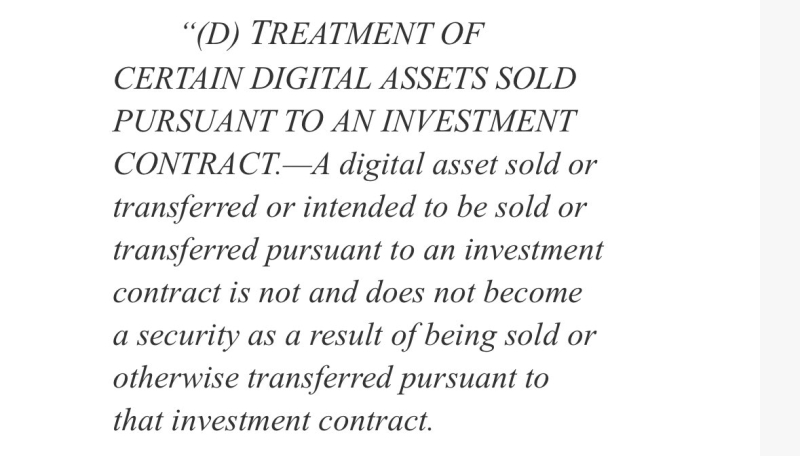

The image outlined a crucial section of the bill: “A digital asset sold or transferred pursuant to an investment contract is not and does not become a security as a result of being sold or otherwise transferred pursuant to that investment contract.”

Best Crypto Exchanges and Apps September 2024 Must Read Top Meme Coins to Buy Now: What You Need to Know Must Read Top 10 Web3 Games To Explore In 2024; Here List Must Read

Source: Bill Morgan, X

Meanwhile, this section directly aligns with Judge Torres’ summary judgment in the Ripple vs. SEC lawsuit. She concluded that XRP itself is not a security, though its sale or offer to institutions could be classified as such. This distinction has been pivotal in shaping the conversation around digital asset regulation.

Ripple Lawsuit: Legal Strategy and Community Support

The Ripple community, including legal experts and advocates, has been instrumental in pushing for the crypto regulation and clarity over it. CryptoLaw, founded by Deaton Law Firm, credited the Ripple vs. SEC lawsuit and the relentless efforts of the XRP community in influencing the creation of the FIT 21 bill.

For context, a recent report from CryptoLaw highlighted that Judge Torres’ decision and the persistent advocacy for clarity from the XRP community were crucial in drafting the bill’s provisions. Specifically, the section clarifying the treatment of digital assets sold pursuant to an investment contract reflects the legal arguments and conclusions from the Ripple case.

Meanwhile, in another post, the XRP lawyer addressed concerns about the FIT 21 bill, emphasizing its non-retrospective nature. Morgan clarified that the court’s decision, which found XRP is not a security, remains unchallenged by the SEC and will not be affected by the new legislation.

Notably, his comments came in response to a post stating that under FIT 21, XRP would not be considered decentralized. Morgan’s insights underscore that the bill, recently passed by the US House, will not alter the court’s existing rulings regarding XRP’s legal status.