Nate Geraci, president of The ETF Store, hints at the potential approval of a spot Solana ETF.

Edited By: Saman Waris

- Per Nate Geraci, the U.S. SEC may approve spot Solana ETFs next month.

- WIF, BONK, JUP, and MEW are Solana-based tokens that might see significant gains if the SEC approves a Solana ETF.

The current market sentiment looks bullish following United States President Joe Biden’s decision to withdraw from the re-election race.

Nate Geraci speaks on Solana ETFs

After Biden’s announcement, Nate Geraci the president of The ETF Store made a post on X (formerly Twitter) and hinted at a potential approval of spot Solana [SOL] Exchange Traded Fund (ETF).

Geraci predicted that ETF issuers such as BlackRock, Fidelity, VanEck, and others will soon file for a combined spot Bitcoin [BTC], Ethereum [ETH], and Solana ETF within the next few months.

As of now, ETF traders are only trading Bitcoin ETF and there is a high chance that the US Securities and Exchange Commission (SEC) will approve Ethereum ETF within the next month.

Whereas, out of 11 ETF issuers only two–VanEck and 21Shares have submitted 19b-4 filings with the SEC and more filings may come in the coming days.

However, Geraci’s post signaled potential approval of Solana ETF in the next month.

If this prediction proves accurate and the U.S. SEC approves spot Solana ETF, then we may see a massive positive impact on the price of Solana and the memecoins on its ecosystem.

This includes dogwifhat [WIF], Bonk [BONK], Jupiter [JUP], and cat in a dogs world [MEW].

What’s next for Solana?

According to expert technical analysis, Solana was looking bullish at press time, as SOL moved above the 200 Exponential Moving Average (EMA) on a daily time frame.

Despite this bullish trend, it faced strong resistance near the $186 level.

The current market sentiment and investors’ interest suggest that SOL could break this resistance level. If this does come to pass, we may see upward momentum toward the $200 level or even higher.

Solana’s major liquidation level

Additionally, investors’ and traders’ interest and confidence are continuously increasing.

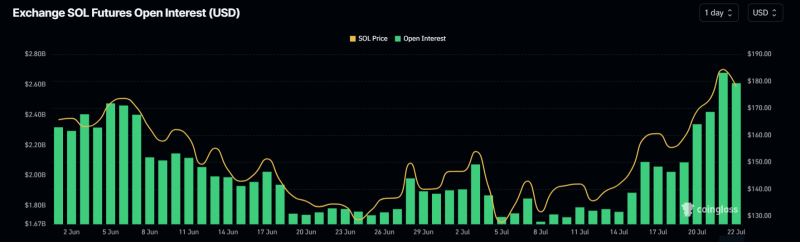

According to the on-chain analytics firm CoinGlass, SOL’s Open Interest has increased by over 9% in the last 24 hours, being at its highest level since June 2024.

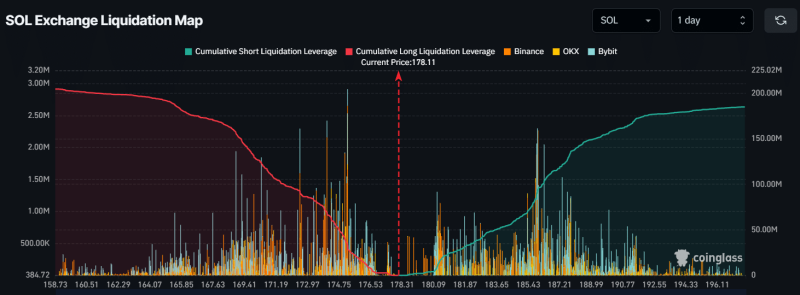

Liquidation data indicated that bulls’ long positions are more significant than the short sellers’ positions. Furthermore, short sellers believed that the SOL price won’t surpass the $186.5 level.

According to Coinglass, $108 million in short positions have been built at the $186.5 level.

Is your portfolio green? Check out the SOL Profit Calculator

As of the time of writing, SOL was trading near $179 and has experienced an impressive price surge of over 4% in the last 24 hours. It also reached an intraday high of $185.

Over the long term, SOL has gained over 18% in the last seven days and has outperformed top assets like Bitcoin and Ethereum.