There is news on the horizon regarding the Polygon crypto project and its programme to develop a Blockchain 2.0 that will allow the use of unified liquidity between different layers.

The new infrastructure, whose architecture was announced a few hours ago by the Polygon Labs team, will serve as the backbone of the Internet of Value for the next 10 years.

Read the article for full details.

The latest developments for the Polygon crypto project’s unified liquidity blockchain

Polygon, one of the most important projects in the crypto sector, recently previewed what will be the backbone infrastructure of the new Blockchain 2.0 system.

The aim is to create the next layer of value for the internet, capable of delivering unified liquidity and unlimited scalability.

Polygon’s new design includes massive use of zero-knowledge cryptographic proofing technology, which will be central to taking the ecosystem to the next level.

The announcement, posted on Twitter by the official Polygon Labs team and co-founder Sandeep Nailwal, follows the community’s recent suggestion to upgrade the PoS network (i.e. the main network on which the MATIC token runs).

There is talk of a layer 2 ZkEVM Validium that inherits Ethereum’s security while keeping the tx on its own chain instead of ‘transporting’ it on Layer 1.

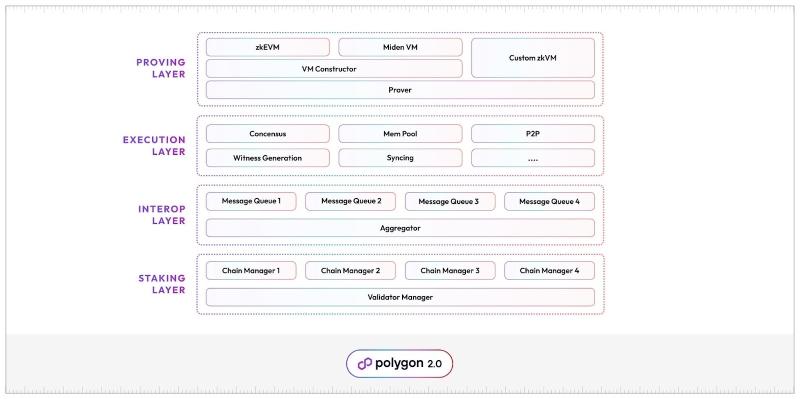

In more detail, the latest update to the Polygon 2.0 architecture includes the interconnection of 4 different layers, each of which enables an important process within the network:

- Staking layer

- Interoperability layer

- Execution layer

- Demonstration layer

The staking layer represents a Proof-of-Stake blockchain, allowing Polygon’s native token, MATIC, to bring decentralisation to the ecosystem with a pool of validators and a restake model.

The second layer, that of interoperability, lays the foundations for a cross-chain communication system between the various parties, making the user experience as simple as if they were operating on a single chain.

All of this is EVM-compliant, with the use of ‘ZK proofs‘ that preserve the privacy of network participants.

The execution layer allows Polygon to create transaction batches, or blocks. It contains numerous components that are also present in blockchain infrastructures focused on value exchange (e.g. Bitcoin and Ethereum).

These components include P2P, consensus, database, synchronisation and mempool.

Finally, the proof layer represents a flexible substrate capable of proving that all transactions performed on the Polygon Chain are valid.

The benefits of its implementation include more efficient proof generation and verification, easy and efficient aggregation of zk proofs, and more secure cross-chain communication channels.

Over the coming weeks, the Polygon Labs team will be exploring the key themes of each layer and explaining how they work in detail.

The final transition to Polygon 2.0 is planned for the first quarter of next year, with progress being made throughout this year.

We remain excited about the developments that Polygon and its team are making in the blockchain space. It is a real revolution.

Insight into Polygon ZkEVM metrics

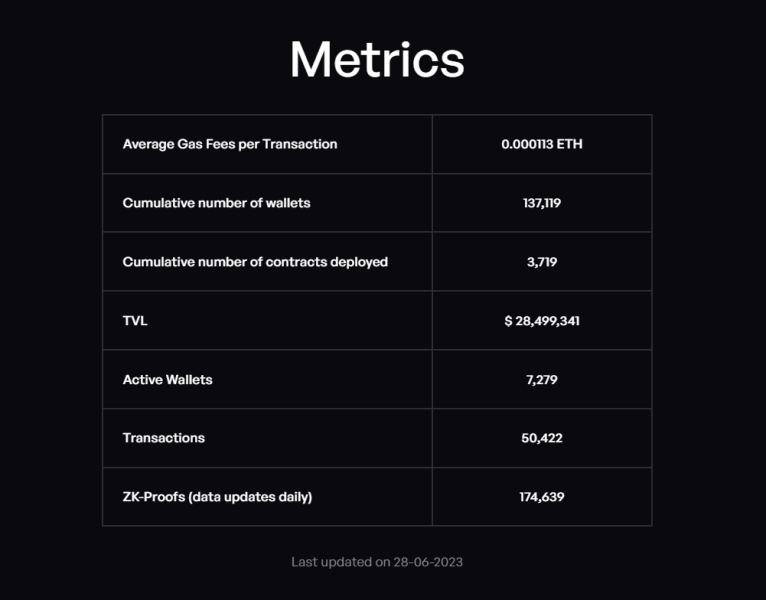

Polygon ZkEVM, one of the main layer 2 blockchains within the vision of the Crypto Project, represents a rapidly growing network with metrics that indicate a strong interest from web3 users.

On Polygon’s official website we can find some very interesting data such as TVL, cumulative number of wallets, average gas price, active wallets, transactions and zero-knowledge crypto proofs.

The network is not yet at its peak, having been launched on 27 March and with many updates still to come.

Transaction throughput, at 0.57 TP/s according to L2beat, is still far below the levels recorded by other rollups, whether zk or optimistic, such as Arbitrum, ZkSync Era, Optimism, etc.

Even on the fee side, although the infrastructure consumption is much lower than Ethereum, it is still too expensive to compete with other layer 2 scaling solutions.

In any case, it can be objectively stated that the volumes within the network are extremely positive and have been growing since its inception.

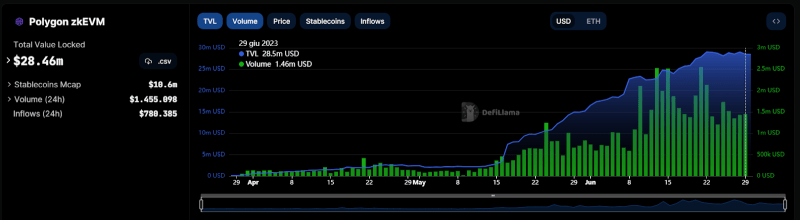

The Total Value Locked (TVL), which represents the total capital locked up in the network’s smart contracts, is also on the rise and could soon approach $100 million.

DefiLlama data

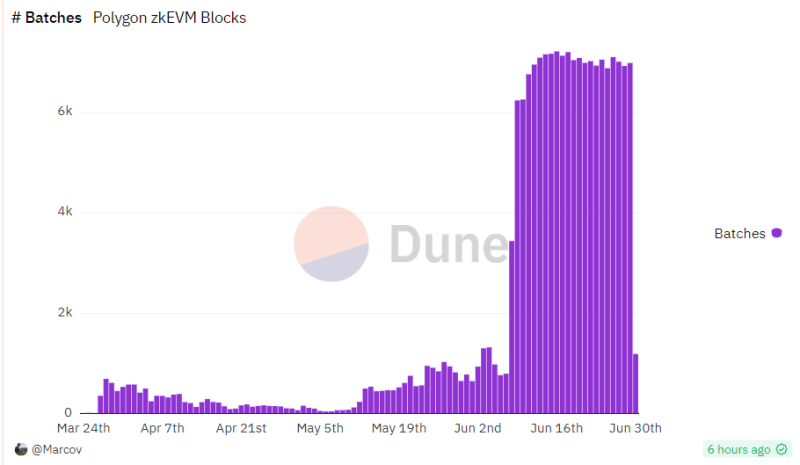

It is also worth noting how transaction batches have increased in recent days, according to data from Dune Analytics.

Specifically, since the 7th of June we have seen a significant increase in this metric from 800 blocks posted daily to the current 7000 recorded yesterday.

This indicates an increase in the underlying activity of the zk infrastructure, which is attracting many users to transact in anticipation of a potential airdrop that has been rumoured for some time.

In the new Polygon 2.0 ecosystem, there may indeed be room for another token after MATIC.

Let’s stay tuned to see how Polygon’s zk network develops and whether it can compete with other, more advanced solutions.