Coinbase, despite regulatory hurdles, could double its 2022 revenue by capturing a fraction of Binance’s trading volume.

- Coinbase’s forecasted revenue surge could rival Binance’s dominance.

- Base’s vibrant user engagement strengthened Coinbase’s competitive stance.

Despite navigating a turbulent crypto market and grappling with regulatory obstacles over the past year, Coinbase appeared to be on the brink of experiencing remarkable growth in the foreseeable future.

Is your portfolio green? Check out the BNB Profit Calculator

Coinbase moving swiftly

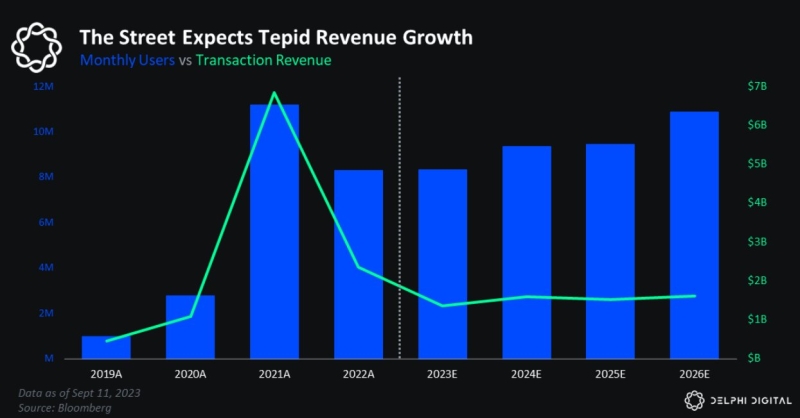

Delphi Digital’s data analysis unveiled an interesting possibility. If Coinbase could capture just a quarter of Binance’s present futures trading volume, even with slightly reduced fees, it would inject a staggering $1.8 billion of additional revenue to its bottom line.

This impressive sum would nearly double its total transaction revenue for the entire year of 2022.

To put this projection into perspective, industry consensus estimates had not predicted Coinbase’s total transaction revenue to reach the $1.8 billion mark until the year 2026.

This forecast underscored the enormous growth potential that Coinbase held within the cryptocurrency ecosystem.

By harnessing a significant share of Binance’s trading activity, Coinbase could substantially swell its revenue streams and mount a formidable challenge to Binance’s dominant market position.

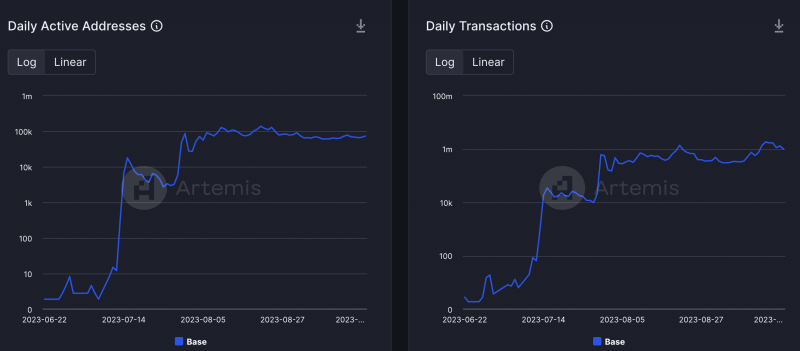

Furthermore, Coinbase’s Layer 2 solution, known as Base, exhibited robust performance metrics. According to data compiled by Artemis, as of 1 August, Base boasted an impressive tally of 72,790 addresses.

The surging adoption and activity on the Base network appeared to be inextricably linked to the popularity of FriendTech, a significant contributor to the growth of the Base ecosystem.

FriendTech’s distinctive appeal lay in its capacity to remunerate content creators handsomely, with figures like 4,090 ETH disbursed in the past 10 days alone. This financial incentive not only attracted creators but also fostered an environment conducive to the platform’s expansion.

One of the reasons FriendTech has taken over your feed: total fees paid to "creators" in the past 10 days:

FriendTech: 4,090 ETH

All ETH NFTs: 610 ETH pic.twitter.com/9S8oe1dt71— NFTstats.eth (@punk9059) September 19, 2023

BNB struggles

Collectively, these factors placed Coinbase in an advantageous position to mount a serious challenge to Binance’s supremacy. Despite contending with regulatory hurdles and legal disputes, Binance, and its native token BNB, faced the specter of potential adverse repercussions.

Realistic or not, here’s BNB’s market cap in BTC’s terms

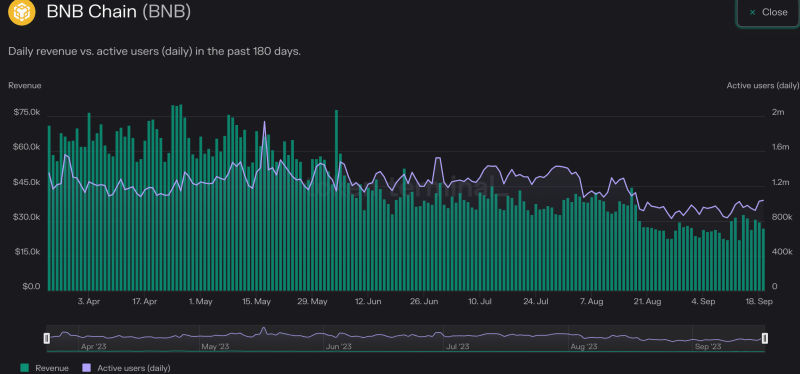

Data sourced from Token Terminal hinted at a slight uptick in activity on the BNB blockchain. A 0.2% growth rate was observed over the past month. However, this surge in activity was not mirrored in revenue generation, which suffered a 27.7% downturn during the same period.

As of the time of writing, BNB was trading at $216.91. It registered a modest 0.61% dip within the preceding 24-hour timeframe.