Bitcoin surges past the key $40,000 amid a macro liquidity boost, but traders’ predictions include a BTC price crash of 25% or more.

5999 Total views 13 Total shares Listen to article Bitcoin (BTC) starts the first week of December looking better than it has since early 2022 — at over $40,000. BTC price action is delighting bulls already as the month begins, with the weekly close providing the first trip above the $40,000 mark since April last year. Shorts are getting wiped and liquidity taken as the bull run sees its latest boost on the back of macroeconomic changes and anticipation of the United States’ first spot price exchange-traded fund (ETF). Despite misgivings and some predicting a major price retracement, Bitcoin continues to offer little respite for sellers, who continually miss out on profits or are left waiting on the sidelines for an entry price that never comes. The party mood is not just reflected on markets — Bitcoin miners are busy preparing for the halving, and with the hash rate already at all-time highs of its own, the trend is set to continue this week. Is there more upside left, or is Bitcoin getting ahead of itself? This is the question that longtime market participants will be asking in the coming days as legacy markets open and adjust to a post-$40,000 BTC price. Cointelegraph takes a closer look at the state of Bitcoin this week and examines the potential volatility catalysts lying in store for hodlers. Bitcoin is firmly reminding investors of “Uptober” as the month gets underway — by liquidating shorts and beating out key resistance levels. The fun began at the weekly close when $40,000 came into view for the first time since April last year. Bulls did not slow down there, however, and BTC/USD continued rising to current local highs of $41,800, data from Cointelegraph Markets Pro and TradingView confirms. In doing so, Bitcoin wiped short positions to the tune of over $50 million on Dec. 4 alone, per statistics from CoinGlass — already the largest single-day tally since Nov. 15. Perhaps understandably, many traders are calling for upside continuation toward $50,000, with leveraged short liquidity slowly disappearing as BTC price performance edges higher.Bitcoin surges past $40,000 — but a serious correction remains on the watchlist

#bitcoin continuing to work through the 3x, 5x, 10x short liquidity. pic.twitter.com/aRwvJil3c6

— Decentrader (@decentrader) December 4, 2023

“Someone still aggressively chasing price here,” popular trader Skew wrote during coverage of live market moves.

$BTC thoughts

Low 40's would be the perfect bull trap IMO.

• Bear stops trigger (I originally had my stop here but opted for manual intervention weeks ago).

• Fresh wave of bull FOMO upon "broken resistance". Exit liquidity generated.

• Monthly resistance *looks* as if it's…— Crypto Chase (@Crypto_Chase) November 22, 2023

“To me, this cycle is no different than others. Currently up only, soon to be down only. This is essentially how BTC always trades,” he continued in part of a fresh analysis.

Key Events This Week:

1. JOLTs Jobs Data – Tuesday

2. ISM Non-Manufacturing PMI – Tuesday

3. ADP Nonfarm Employment Data – Wednesday

4. Initial Jobless Claims Data – Thursday

5. Consumer Sentiment Data – Friday

6. November Jobs Report – Friday

We are one week out from the…

— The Kobeissi Letter (@KobeissiLetter) December 3, 2023

Gold price spike sparks concerns as U.S. liquidity rushes back

Others noted that Bitcoin and crypto gaining is likely due to more than just data.

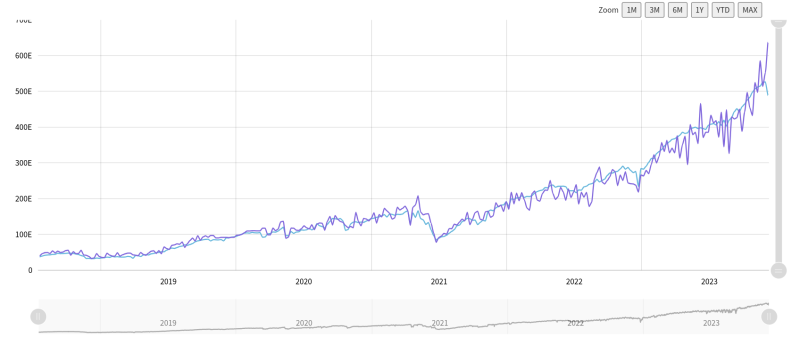

They are all a function of Global Liquidity.

Global Liquidity goes up, and they all follow. pic.twitter.com/Zekzclup6g

— Philip Swift (@PositiveCrypto) December 4, 2023

The Fed’s reverse repo facility is declining rapidly, injecting additional liquidity into the economy — arguably the key variable for risk asset performance worldwide.

“This is money that’s otherwise stashed with the Fed overnight which is entering the economy/markets. This tends to help out risk assets and bring DXY down,” Daan Crypto Trades wrote in a commentary on an accompanying chart.

The U.S. Dollar Index (DXY), a measure of USD strength against a basket of major trading partner currencies, is currently in the midst of a modest rebound after hitting four-month lows last week.

Liquidity is on the radar of institutional names within the crypto space, among them Dan Tapiero, founder and CEO of 10T Holdings.

The recent U.S. bond rout provides a rare buying opportunity on par with the 2008 global financial crisis and 2020 COVID-19 crash, he argued last week, again concluding that liquidity should “rush” into stocks and Bitcoin.

NOTHING goes down forever.

H/T @APompliano for the chart.

Interest rates peaked/ yields going down a lot next year.

2 greatest buying opportunities of the last 40 years in equity equivalent now in bonds.

2yrs headed back to 3%.

Liquidity rushes into #NASDAQ #Bitcoin #gold pic.twitter.com/uTwBErJt2I

— Dan Tapiero (@DTAPCAP) December 1, 2023

Charles Edwards, founder of quantitative Bitcoin and digital asset fund Capriole Investments, was one figure noting liquidity trends preempting Fed action already — with the largest U.S. financial easing in 40 years occurring in November.

November saw the largest easing in over 40 years! https://t.co/cRRVIpgDFj

— Charles Edwards (@caprioleio) December 4, 2023

As Cointelegraph reported, gold is already reacting, hitting new dollar all-time highs and spiking nearly 4% on the day before correcting.

Such behavior is unusual, others argue, anticipating “something big” occurring this week.

“Unless someone is getting carried out right now after shorting Gold, this is saying something important,” the popular social media commentator and trader known as Horse suggested.

My immediate thought when #Bitcoin pumps, is how hard miners are gonna pump straight after.

— James V. Straten (@jimmyvs24) December 2, 2023

Last month, the estimated hash rate hit new record highs and passed 500 exahashes per second (EH/s) for the first time in Bitcoin’s history.

The trend is going nowhere as December begins — the next difficulty readjustment will add an estimated 1.6% to the already record high tally, reflecting the intensity of competition for block rewards.

Per data from statistics resource BTC.com, this will mark Bitcoin’s seventh consecutive upward adjustment.

“The Bitcoin hashrate will enter the fun stage of its parabolic advanced this cycle as the fourth and final phase of mining is upon us,” Nick Cote, founder and CEO of digital asset marketplace SecondLane, predicted in part of recent X commentary.

“Sophisticated participants who have ∞ resources & government alignment will put the boot to the necks of inefficient miners as the rate of deployment accelerates.”

Alex Thorn, head of firmwide research at crypto education resource Galaxy, meanwhile, made reference to the firm’s “bull case” for hash rate becoming reality.

“This is one of the most interesting charts in the world right now,” he told X subscribers about the hash rate numbers.

“A picture worth a thousand words.”

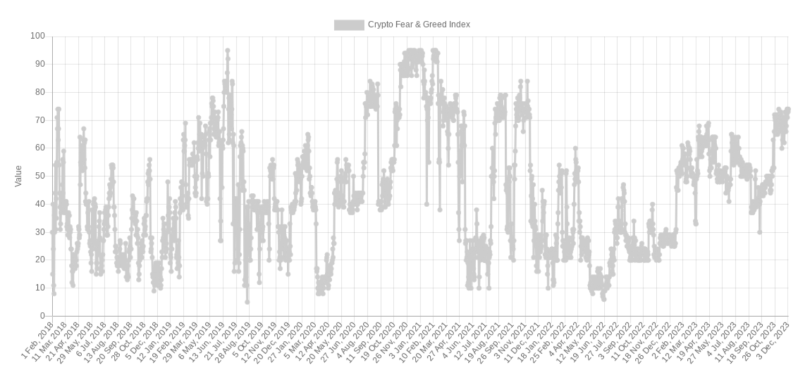

Greed matches $69,000 Bitcoin all-time high

The latest trip to 19-month highs has likely delivered an even larger boost to crypto market greed.

Related: Bitcoin ETF will drive 165% BTC price gain in 2024 — Standard Chartered

Data from the Crypto Fear & Greed Index — the benchmark sentiment indicator — already puts greed levels at highs not seen since November 2021, when Bitcoin set its latest all-time high.

A lagging indicator, Fear & Greed had not taken the trip beyond $40,000 into account at the time of writing but still stood at 74/100 — verging on “extreme greed.”

The index uses a basket of factors to determine the overall mood among crypto investors. Its implications serve to predict marketwide trend reversals when either fear or greed reaches unsustainably high levels.

To that extent, the $69,000 peak marked an anomaly — historical precedent demands that a correction enter when the index passes 90/100. The current bull market could thus have room left to run before irrational exuberance takes hold, commentators have previously argued.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.