- Short-term holder wallets are in the red and may liquidate near their breakeven level at $65,000.

- Long-term holder wallets, with average cost of less than $20,000, are incentivized to hold or boost their coin stash.

As bitcoin (BTC) looks to recover from the July loss, new challenges loom, with onchain data suggesting a potential resistance at $65,000.

The leading cryptocurrency by market value traded nearly 1% higher at $63,200 as of writing, looking to regain some poise after ending June with a 7% loss. June’s drop, which reversed May’s upswing, mainly occurred due to miner selling and concerns that ETF inflows represent non-directional arbitrage bets instead of outright bullish bets.

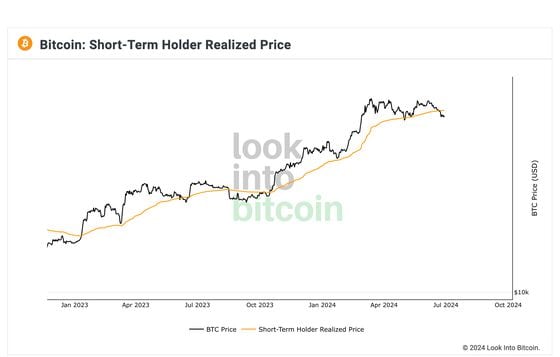

Notably, the decline has pushed prices well below the widely tracked aggregate cost basis of short-term bitcoin holders, or wallets storing cost for 155 days or less. As of writing, the aggregate cost basis for short-term holders was $65,000, according to data source LookIntoBitcoin. Onchain analytics firms consider realized price as the aggregate cost basis, reflecting the average price at which coins were last spent on-chain.

In other words, short-term holders now face losses or hold positions in the red and could attempt to exit the market at a loss or breakeven, potentially adding to selling pressure near $65,000.

“The price of bitcoin has fallen below the aggregate cost basis of short-term holders for the first time since August 2023. In the short-term, we should expect some resistance around the ~$65,000 level as short-term market speculators may look to exit their positions at a ‘breakeven’ level,” analysts at Blockware Intelligence said in the latest edition of the newsletter.

“Last summer when BTC lost the STH RP [realized price] support level, price traded sideways for another two months before finally breaking out again,” analysts added.

Meanwhile, long-term holder wallets are strongly incentivized to maintain or boost their coin stash as their average cost is less than $20,000, per LookIntoBitcoin. Yes, you read it right; their average cost basis is nearly 70% less than the BTC’s going market price.

Besides, bitcoin’s 15% price pullback from the record high of over $73,500 in March may appear substantial for a traditional market investor, but is a normal bull market correction for a long-term crypto holder.

“During the 2017 cycle BTC had 10 drawdowns of 20% or more. This is a normal, healthy, bull market correction. Bitcoin’s price volatility shakes out weak hands and provides opportunities for strategic capital deployment to those with a longer time horizon,” Blockware said.

Edited by Parikshit Mishra.