Even though the concept has been around for a while, decentralized finance (DeFi) had its breakout moment in 2020 during a period that’s popularly described as “DeFi summer”. Decentralized protocols like Uniswap, which used to be niche trading venues for hardcore blockchain enthusiasts, are now competing with and even surpassing the largest companies in the cryptocurrency industry.

DeFi has managed to attract hordes of new users thanks to innovative yield-earning opportunities that are made possible by decentralized smart contract platforms like Ethereum – users can access financial services such as lending and trading within just a few clicks, without having to rely on the approval of any intermediaries. With tens of billions of dollars now being committed to DeFi protocols, the space has also become attractive to institutional investors. However, DeFi is still perceived as a bit of a “Wild West” environment, and it can be difficult for institutions to participate in a compliant way.

Alkemi review

In this article, we’ll be taking a look at Alkemi, a platform for lending and borrowing crypto assets that implements principles from both decentralized finance (DeFi) and centralized finance (CeFi). By leveraging Ethereum smart contracts, Alkemi provides a decentralized system for users who want to earn yield by lending out their cryptocurrencies, or access liquidity by borrowing funds.

Alkemi has created a permissioned lending pool where only verified users can participate, making it much easier to onboard institutional investors to DeFi. The team is also working on launching a permissionless pool, which will be open to all Ethereum users.

The Alkemi project was founded in early 2018 and came out of stealth mode in April 2021 with a launch on the Ethereum mainnet. The project has received backing from investment firms such as ConsenSys Mesh, Techstars, Ledger Prime and Outlier Ventures, as well as individual investors like Richard Ma (Quantstamp), Jeremy Drane (Nifty’s) and Jordan Fried (Hashgraph).

The Alkemi project was founded by Ryan Breen alongside co-founders Brian Mahoney and Ben Cooper.

Alkemi Earn

Currently, Alkemi’s Earn platform features the Verified pool, where all participants need to pass a Know Your Customer (KYC) process. Both individual and institutional users can complete the KYC and participate in the pool. Soon, Alkemi will also feature an option for users who don’t want to complete KYC – this is covered in a section further down in the article.

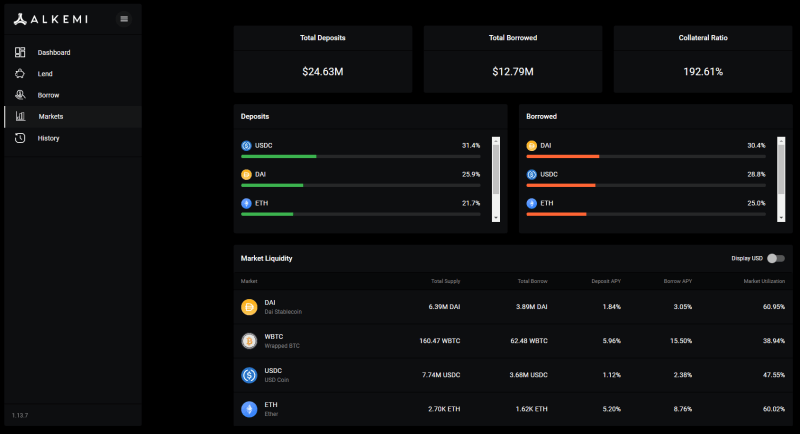

At the moment, the Earn platform supports the lending and borrowing of 4 key crypto assets – Ethereum, Wrapped Bitcoin, USD Coin and Dai. The exchange rates between the different assets supported on Alkemi earn are calculated through the Chainlink decentralized oracle network.

In order to participate, users have to complete KYC, whitelist their Ethereum address and connect through either MetaMask or WalletConnect.

DeFi users who are already familiar with lending protocols such as Compound will be able to get accustomed to Alkemi very easily, and the platform features a clean design that makes it easy to track positions and the APYs that are currently available for both lenders and borrowers.

Since Alkemi is designed to serve both professional and individual investors, the Earn platform also comes equipped with a reporting functionality that generates reports about balances, asset allocations and transaction history.

The Alkemi Earn user interface.

The ALK token

While Alkemi’s permissioned KYC-verified pools represent an attractive option for bigger investors that are looking to engage with DeFi in a compliant and transparent manner, the platform will become much more interesting for the average DeFi user after the token generation event (TGE) for the ALK token.

The TGE will be accompanied with the launch of an Open pool, which will provide a “traditional” permissionless DeFi user experience. According to the project’s roadmap, the permissionless pool and ALK token launch is planned for Q3 2021, which means we will likely see these developments in action soon.

ALK will be an ERC-20 token that serve as the governance token of the Alkemi Network decentralized autonomous organization (DAO). One of its main use cases will be governance – holders will be able to create and vote on key proposals concerning the protocol. ALK holders will be able to influence the protocol’s fee models, add or remove assets that are supported by the protocol, and also influence the protocol’s risk parameters.

Beyond governance, the Alkemi team also plans to give the ALK token additional utility by implementing a staking system. ALK holders will have the option of staking their tokens to help provide additional security to the protocol and earn rewards in return.

ALK will have a total supply of 200 million tokens. 50% of the supply is allocated to the Alkemi team and the project’s backers, while the remaining half will be distributed to users through liquidity mining and the project’s ecosystem fund. The liquidity mining program will distribute 35% of the total ALK supply, which translates to 70 million tokens.

More specifically, the planned ALK supply distribution looks like this:

- Team and advisors: 20%

- Prior backers: 10%

- Investors: 10%

- Founding entity: 10%

- Liquidity rewards: 35% (distributed after token generation event)

- Ecosystem fund: 15% (distributed after token generation event)

The ALK token is expected to release in July 2021, but the Alkemi team hasn’t yet provided a more specific date for the launch.

Liquidity mining

Like many other leading DeFi protocols, Alkemi will feature a liquidity mining program that will incentivize users to provide liquidity to the protocol. In return, users will be able to earn rewards in the form of ALK tokens. The liquidity mining program will last for 4 years, with 8.75% of the total ALK supply being distributed each year. At the moment, the liquidity mining program is only available to lenders who can supply $50,000 worth of assets or more.

The bottom line

The Alkemi team seems to be banking on a future where DeFi protocols can function within regulatory frameworks and institutional investors are comfortable with engaging in this exciting sector. However, the project also hasn’t forgotten about DeFi’s roots and is also building permissionless solutions, as well as decentralized governance through a DAO.

With the TGE for the ALK token expected soon, it will be very interesting to follow the project’s development and see whether Alkemi has what it takes to earn its place in the heavily contested DeFi sector. The team has already delivered on a decent chunk of its plans, as the Alkemi Earn platform is already live and offers a very elegant interface for accessing the protocol’s crypto asset lending and borrowing capabilities.