Short-term holders can help raise Bitcoin’s price, if this metric is to be believed.

Edited By: Saman Waris

- The Realized Price of short-term holders turned positive.

- A consolidation pattern emerged for addresses with less than 1 Bitcoin.

Bitcoin’s [BTC] recent decline below the $40,000 mark sent shockwaves across the cryptocurrency sector. However, short-term holders stood to gain.

Short-term holders and long-term effects

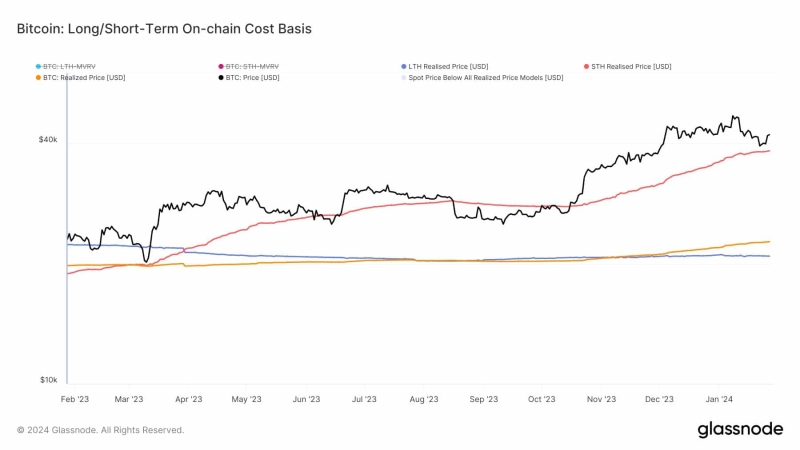

Bitcoin’s value, which remained below $40k from the 23rd to the 26th of January, aligned with the Realized Price of short-term holders.

This level has historically served as a supportive floor during previous upward market trends.

Inasmuch, at press time, both the Realized Price of short-term holders and the overall Realized Price were on an upward trajectory. This indicated a bullish sentiment, as coins were being acquired at higher prices.

When AMBCrypto compared the current situation to the 2021 bull run, we found that the bull run could gain more strength once the STH Realized Price hits $38,300 and the overall Realized Price reaches $60,000.

Greater than one

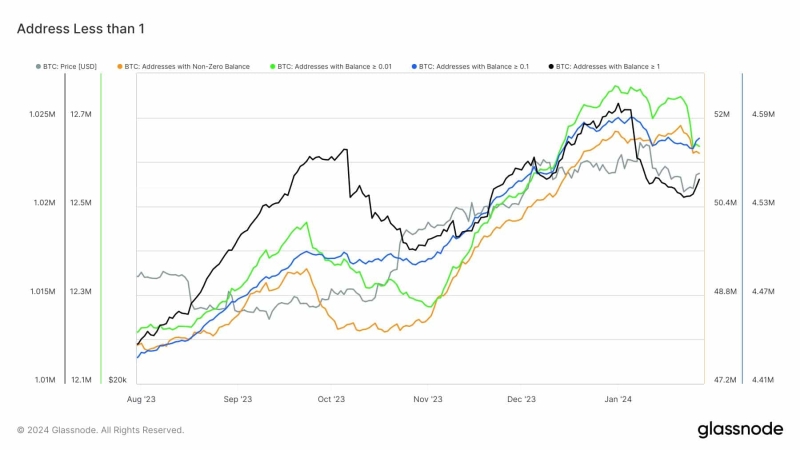

However, addresses holding less than 1 Bitcoin consistently showed a downward trend since the peak at 49k.

There were indications that these addresses reached a bottom, and a notable consolidation pattern was emerging at press time, particularly around the $40,000 mark.

This shift suggested a potential stabilization in the holdings of smaller Bitcoin addresses after the previous downward movement.

The consolidation and stabilization of addresses holding less than 1 Bitcoin around the $40,000 mark can have several positive implications for the king coin.

First, it may indicate a point of equilibrium or support in the market, suggesting that smaller holders were finding value or confidence in maintaining their positions at this level.

This stability can contribute to an overall sense of market confidence, as it implies that a significant portion of retail investors are content with the current valuation.

Second, the consolidation of around $40,000 might be interpreted as a psychological support level.

If this price point proves to be a robust support zone, it could attract more buyers who see it as an opportune entry point.

Read Bitcoin’s [BTC] Price Prediction 2024-25

This increased demand has the potential to drive the price higher, creating positive momentum.

State of BTC

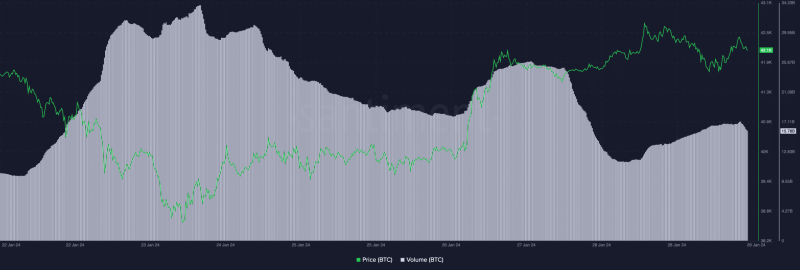

At press time, BTC was trading at $42,166.36, with its price having fallen by 0.95% in the last 24 hours. The volume at which the coin was trading also declined from 33 billion to 15 billion during this period.