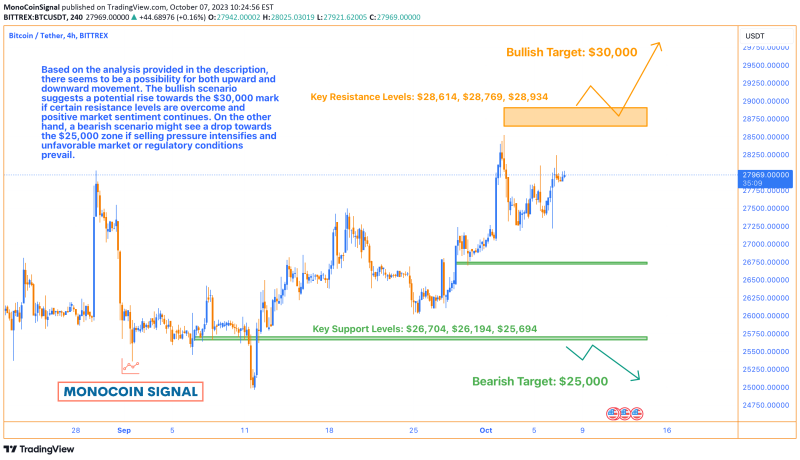

Bitcoin’s journey in the market continues as it settles around the $27,933 mark, taking a slight step back from the $27,737 level. This recent movement is part of a 23.6% retracement following a notable climb from $24,900 to $28,613. The market is on a roller-coaster ride, with both bullish and bearish forces trying to take the reins. On one hand, there’s a positive sentiment pushing towards the targets of $28,404, $28,498, $28,769, and $29,151. However, standing in the way are formidable resistance levels at $28,614, $28,769, $28,934, among others, which are akin to tough hurdles on the track.

Most Probable Scenario:

Amid the current market trends and a wave of bullish sentiment marked by an increase in address creations, there’s a cautious optimism brewing. The scenario that seems most likely is a gradual ascent towards the prestigious $30,000 mark. This promising outlook is contingent on breaking through the stated resistance levels and maintaining a steady upward pace. The positive market mood coupled with potentially favorable regulatory news could be the wind beneath Bitcoin’s wings. However, staying alert is crucial as any negative turn in market or regulatory conditions could trigger a bearish reaction, driving Bitcoin towards the support zones around $26,704, $26,194, and $25,694.

On the flip side, should the market sway bearish, Bitcoin might find itself on a downward slope towards the $25,000 mark. This gloomy scenario could play out if selling pressure ramps up around the current resistance levels or if there are unfavorable market or regulatory developments. Trade active: Recent Updates:

The latest analysis depicts a tug-of-war between bullish and bearish sentiments. As of October 8, 2023, Bitcoin awaits fresh technical guidance post its moderation following a failure to break above $27,737 and $27,992 levels, which are crucial retracement levels related to its recent high around $28,613. While Elliott Wave analysis suggests an important market decision looms around the $28,000 mark, Bitcoin’s price strengthening amidst a struggling economy reinforces its safe haven narrative. Projections hint at a possible rise to around $33,202 by October 11, 2023, with a nearly 19.04% increase, depicting a bullish sentiment albeit with a neutral Fear & Greed Index of 49. Moreover, a surge of nearly 9% could propel Bitcoin to $28,435 by October 13, 2023.