There was a bearish order block at $0.55 on the daily chart that formed on 29 August, but XRP bulls have forced prices higher since mid-September and signaled a breakout was likely

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

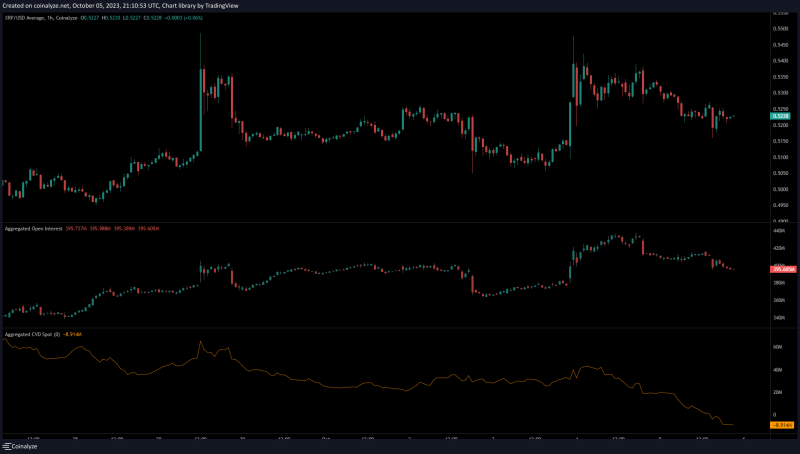

- XRP noted high price volatility in recent days

- Despite the fluctuations, the price action revealed that the bulls likely have a superiority

Ripple [XRP] saw increased volatility over the past week. The bulls and bears fought a pitched battle around the $0.54 level. At the time of writing, the bears have been able to defend this resistance.

Read Ripple’s [XRP] Price Prediction 2023-24

A previous XRP price action analysis by AMBCrypto showed that a retracement to $0.49-$0.5 was possible. This remained true, although XRP dipped to $0.506 on the day of publication of the recent report. Can bulls look to enter longs if we get a retest?

The higher timeframe bearish order block continued to stand firm

The recent volatility saw XRP’s H4 market structure flipped bullish once more after the sudden spike to the $0.547 resistance on 3 October. Since then the price dipped lower and was trading at $0.523 at press time.

A set of Fibonacci retracement levels (pale yellow) were plotted based on the rally from $0.4912 to $0.549. This occurred last week, but the Fib levels showed that the $0.503-$0.513 region presented an ideal buying opportunity in the short term. The bullish target would be the $0.563 level, which was the 23.6% extension level.

There was a bearish order block at $0.55 on the daily chart that formed on 29 August. It has not been breached yet, but XRP bulls have managed to form higher lows since mid-September. This price action pointed toward bullish intent. The Chaikin Money Flow’s (CMF) reading of +0.12 also signaled notable capital inflow to the Ripple market.

The Relative Strength Index (RSI) was at 50.5 and conveyed momentum was almost exactly neutral. Meanwhile, the Directional Movement Index (DMI) showed that the bullish trend over the past two days had weakened considerably. This was revealed by the +DI’s (green) drop below the 20 mark.

The short-term sell pressure on XRP could force minor losses

In the past 24 hours, both the price and the Open Interest (OI) dropped lower, highlighting short-term bearish sentiment. More worryingly, the spot Cumulative Volume Delta (CVD) has nosedived as well, showcasing a lack of demand for XRP in the spot markets.

Is your portfolio green? Check the XRP Profit Calculator

This showed that the token could be forced to drop toward $0.5 again, but it remained unclear if the bears were strong enough to take prices below $0.49. Until that time, bulls could look for buying opportunities near the $0.5 support.