SOL’s open-source nature of the endeavor may facilitate more developer interest in the network. An outcome that could potentially turbocharge Solana’s ecosystem growth.

- Solana was to experiment with tokenized/synthetic assets on its network.

- The pursuit might breathe new life into Solana’s TVL.

Over the last few weeks, we have seen blockchain networks aggressively push toward more development. Solana [SOL] in particular has been quite active in that regard and its latest announcement highlights its move to explore opportunities.

Is your portfolio green? Check out the Solana Profit Calculator

Solana is reportedly looking for growth opportunities in the synthetic assets segment. The network recently announced that it has published an open-source reference implementation to facilitate its efforts toward synthetic assets. This constitutes an open invitation to developers who might be interested in launching those types of assets with a low-friction approach.

While Solana has expressed interest in supporting developers to achieve that goal, the announcement has multiple facades. For starters, the open-source nature of the endeavor may facilitate more developer interest in Solana. An outcome that could potentially turbocharge Solana’s ecosystem growth and development.

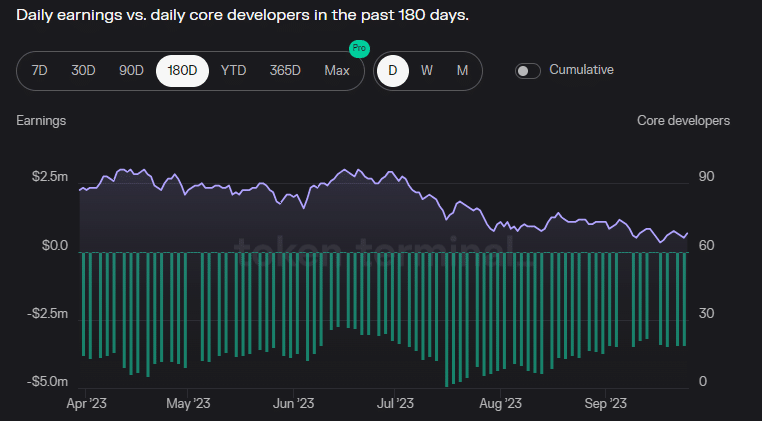

Data on Token Terminal revealed that Solana’s core development count has been declining for the last three months. Network earnings dipped to their lowest point in June based on a six-month timeline.

On the other hand, the development could put Solana on regulators’ radar. This is because synthetic assets especially in tokenized form have previously faced regulatory pressure. As such, it should be interesting to see how Solana will overcome such challenges.

Could synthetic assets rejuvenate Solana’s TVL growth?

There is no doubt that Solana’s TVL has underperformed since its historic peak. Meanwhile, numerous projects have overtaken its TVL. However, the underlying mechanisms that underpin most tokenization strategies on other networks and protocols often involve liquidity. In most cases, tokenized assets are collateralized. If that is the case with Solana, then its TVL might recover faster.

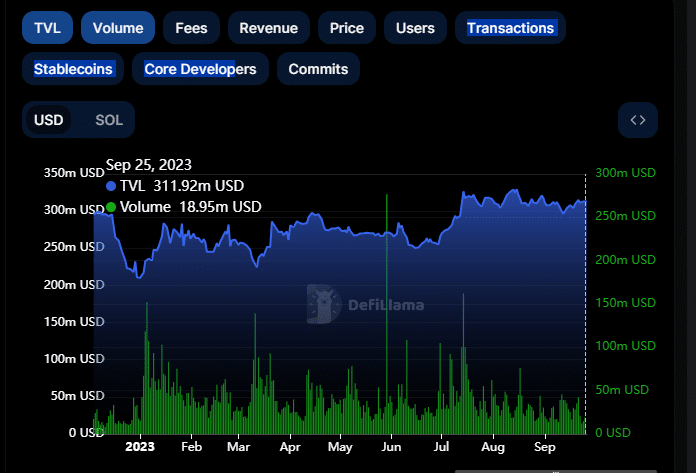

Nevertheless, Solana’s TVL did manage to resume some upside so far this year compared to its YTD lows. According to DeFiLlama, the network had as low as $210.08 million in TVL on 1 January. Its current TVL at the time of writing was $313.27 million.

Despite the relatively slight but noteworthy TVL growth, the volume underperformed and appeared lower than it was at the start of the year. This was with the expectation of large spikes every now and then. Perhaps a testament to the uncertainty that prevailed more recently.

How many are 1,10,100 SOLs worth today

The slight recovery in Solana’s TVL suggested that the network might require a change of tactic to embark on recovery. The open-source invitation to developers to build tokenized assets might turn the tide for Solana.