Contents

Break-Even Analysis Explained

Definition

Break-even analysis is a way of determining the sales volume of a product or service at which a business can recoup the cost of offering that product or service. Calculating a break-even point (BEP) requires assessment of fixed and variable costs, as well as pricing for that product or service.

Definition and Examples of Break-Even Analysis

Assuming that the objective of most businesses is to make a profit, knowing what level of sales is necessary to break even—how many units or how much of a service—will help minimize risk. A break-even analysis can express a BEP on a monthly, quarterly, or annual basis.

- Alternate name: break-even quantity (BEQ)

Note

Establishing a BEP can help business leaders set a price for a product or service that is both competitive and necessary to remain in operation.

How Break-Even Analysis Works

There is a cost to produce any product or offer a service. A portion of the cost is fixed and another portion of the cost fluctuates based on the number of units produced. Estimating the BEP requires accurate information about fixed and variable costs.

Fixed costs do not vary with sales volume and may include rent, utilities, salaries, and insurance. Variable costs fluctuate with sales volume and may include materials and labor.

How To Calculate the Break-Even Point (BEP)

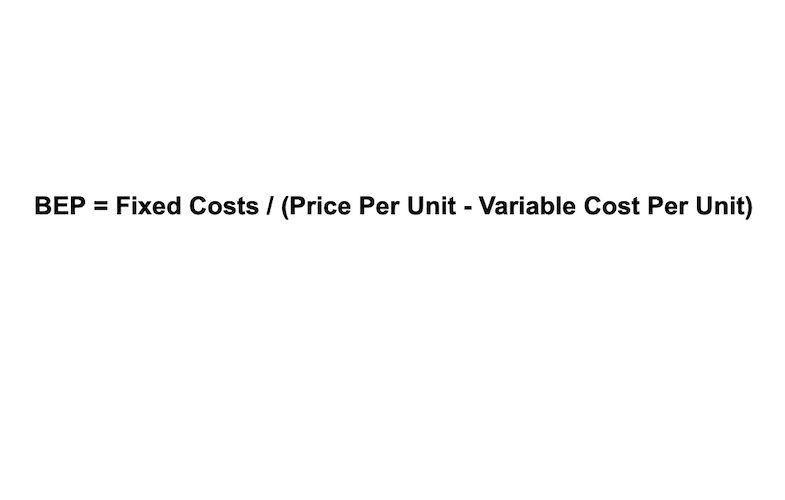

Put simply, the BEP is calculated by dividing the total fixed cost by the difference in price and cost per unit of the product or service.

Consider the example of a potter who makes ceramic salad bowls. Let’s say their monthly fixed costs add up to $3,000, which covers rent for a studio, utilities, equipment costs, and regular marketing expenses. Variable costs, which are primarily clay and labor (if they have employees), average $6 per bowl.

If they sell each bowl for $40, using the formula above, the BEP can be calculated like this:

BEP = $3,000 / ($40 – $6) = 88.24

Rounding up, the potter needs to sell 89 bowls per month to break even, given the pricing and costs for the bowls.

Note

The difference between the price of one unit and the variable cost incurred to produce it is known as the contribution margin.

In the example of the potter, the contribution margin per bowl is $34.

Typically, products or services with a positive contribution margin may make business sense to continue with, while those with a negative contribution margin may not since they may not be profitable.

Contribution Margin vs. Gross Margin

It is important not to confuse contribution margin with gross margin (also commonly referred to as gross profit margin). Gross margin is the profit a company makes on total sales after accounting for the direct costs, both fixed and variable, associated with producing the goods or services sold.

Gross Margin = Total Revenue – Total Direct Cost of Goods Sold

While the gross margin takes a high-level view of profitability, contribution margin is used to determine financial viability at a single-unit level. Another key difference between the two is that gross margin takes into account fixed costs for its calculations, whereas contribution margin is based only on variable costs.

How To Use Break-Even Analysis

Once BEP has been determined, an entrepreneur should have a better idea whether a business plan will work. For example, the potter from earlier wants to sell more than 89 bowls per month so they can do more than just break even. If they’re confident they can achieve that, their business plan may be on target.

However, if selling 89 bowls per month is not realistic, the business may still work if the potter can decrease the fixed or variable costs, or increase the price charged for each bowl. For example, if they lower their fixed costs to $2,500 by finding a less-expensive studio and lower their marketing costs, they only need to sell 74 bowls per month to break even ($2,500 / $34 = 73.53, rounded up to 74).

If they can lower their fixed costs to $2,500 and lower the variable cost to $4.50 per bowl, that makes the contribution margin $35.50 and lowers the BEP to 70.42, rounded up to 71.

Note

In addition to using BEP to determine what is necessary for a business to pay for its costs, it can be used to help determine whether certain investments are wise.

The potter in our example is profitable under their current strategy, but they want to try to increase their profits by selling more bowls. To do so, they plan to invest in a marketing campaign that will broaden their reach.

The potter can estimate how many additional bowls their broader reach will allow them to sell each month and weigh that against the increased fixed costs that come with paying for additional marketing. The formula will tell the potter how many additional bowls they need to sell to make the campaign a sensible investment.

BEP may also be used to determine if a price increase or decrease is warranted. A price increase will reduce the number of bowls that must be sold to break even, while a price decrease will increase the number of bowls that need to be sold to break even, but may also result in many more bowls being sold.

If the potter needs to sell 89 bowls per month at $40 each to break even, they would need to sell 125 bowls to break even (36 more than before) if they lowered the price to $30 per bowl. If they increased the price per bowl to $45 though, they’d have to sell 77 bowls to break even. However, they may find that they can sell more bowls at a lower price, so a price reduction could be a good strategy.

What Break-Even Analysis Means for Investors

For investors, break-even analysis shows the minimum amount of sales necessary for a company to prevent losses. When analyzing two or more companies that make a similar product or provide a similar service, break-even analysis can help determine whether one company has a significant advantage in terms of lower production costs, pricing power (due to a strong brand), or other factors that allow it to sell fewer units to break even.

Note

Under a very broad interpretation, a form of break-even analysis may even find application in the context of stock and options trading. Investors may be able to calculate the point where they neither make nor lose money.

Calculating trading break-even percentage can be a helpful tool in determining an investment strategy using stop-loss and targets.

In options trading, the break-even point for a call option where the investor neither makes nor loses money is equal to the sum of the strike price and the premium they paid for the call.

For example, if an investor buys XYZ September 50 Call $1.50, it means they have purchased an options contract for XYZ stock that expires in September with a strike price of $50 and paid $1.50 per share in premium. In this case, the investor will break even when the stock price of XYZ is $50 + $1.50, or $51.50.

Similarly, the break-even point for a put option is the strike price minus the premium. So, if in the above example the investor had purchased a put option for XYZ at $50 strike price and paid a premium of $1.50, then the share price of XYZ would need to fall to $50 – $1.50, or $48.50, for the put to break even.

Key Takeaways

- Break-even analysis is a way to determine the sales volume required to recoup the cost of offering a good or service.

- Businesses can determine their pricing strategy based on break-even analysis.

- Companies can use break-even analysis to evaluate viability of new or existing product lines or service offerings.

- Some principles of break-even analysis can be applied to stock and options trading.

Was this page helpful? Thanks for your feedback! Tell us why! Other Submit Sources The Balance uses only high-quality sources, including peer-reviewed studies, to support the facts within our articles. Read our editorial process to learn more about how we fact-check and keep our content accurate, reliable, and trustworthy.

-

Investor.gov U.S. Securities and Exchange Commission. “Investor Bulletin: An Introduction to Options.” Accessed Mar. 8, 2021.