After Bitcoin’s route two weeks ago, when it briefly jumped above $28,000, the price action started to trend sideways again. In addition to that, technicals on the daily chart began to flatten, suggesting the short-term bearish trend is weakening and turning neutral. To support a bearish case, we want to see RSI and MACD start declining and Stochastic continue oscillating within the bearish zone. On top of that, we want to see ADX resume growth, which would imply that the bearish trend is regaining momentum. On the contrary, to support the bullish case, we want to see the mentioned indicators turn to the upside and bullish crossover between DM+ and DM-.

At the moment, we continue to be inclined toward the bearish outlook and expect Bitcoin to drop to the area near $24,000. However, considering that volatility dropped significantly over the past few days and the trend is turning neutral, the chances of a volatile move to either side grow again. Though, there is one thing we want to point out. The data from LookIntoBitcoin indicates no accumulation among large players following the price bust two weeks ago, suggesting “smart money” is not buying yet. As a result, we think the next volatile move may favor the downside over the upside.

Illustration 1.01

Illustration 1.01 shows the daily chart of BTCUSD and simple support and resistance levels based on the recent troughs and peaks.

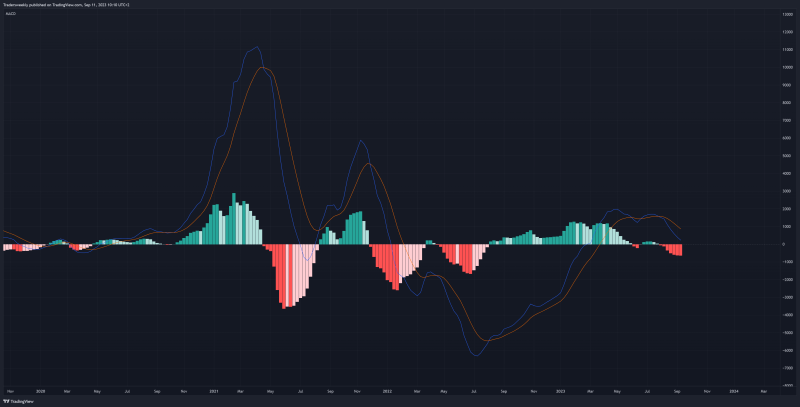

Illustration 1.02

On the weekly chart, we continue to observe MACD. If it breaks below the midpoint, it will be very bearish for Bitcoin.

Technical analysis gauge

Daily time frame = Neutral

Weekly time frame = Bearish

*The gauge does not necessarily indicate where the market will head. Instead, it reflects the constellation of RSI, MACD, Stochastic, DM+-, ADX, and moving averages.

Please feel free to express your ideas and thoughts in the comment section.

DISCLAIMER: This analysis is not intended to encourage any buying or selling of any particular securities. Furthermore, it should not be a basis for taking any trade action by an individual investor. Therefore, your own due diligence is highly advised before entering a trade.

Comment: Illustration 1.03

As Bitcoin dropped to the vicinity of $25,000, there is one more support level we are paying attention to (at $24,756). If this level is broken to the downside, it will mark a new low since mid-June 2023 and strengthen the bearish case.