For about a month now, Bitcoin has been choppy, oscillating mainly within the range between $30,000 and $29,000. Such restrained fluctuations often indicate uncertainty in the market and precede times of elevated volatility. As a result of the current ambiguous situation, we can only wait for new developments to emerge in order for us to take some clues from them as to where Bitcoin might go next. Accordingly, we continue to monitor MACD, Stochastic, and RSI on a daily time frame. In addition to that, we keep observing the number of Bitcoin wallets with balances exceeding 100 BTC and 1,000 BTC. The number of wallets with 100 BTC or more has stayed relatively steady over the past month; the same applies to wallets with 1,000 BTC or more in the balance. This trend suggests that there is not enough buying activity among big players and that they might be waiting for more lucrative prices (plus, it makes us question who is currently buying if large players are not). Besides that, in the past two weeks, the U.S. stock market has exhibited weakness, which can negatively affect risk assets like Bitcoin going forward (if the sell-off continues). Consequently, we are very cautious and stay more inclined toward the scenario with more downside for Bitcoin. On the endonte, if you are wondering whether we still think that Bitcoin can retest its 2022 lows, we do.

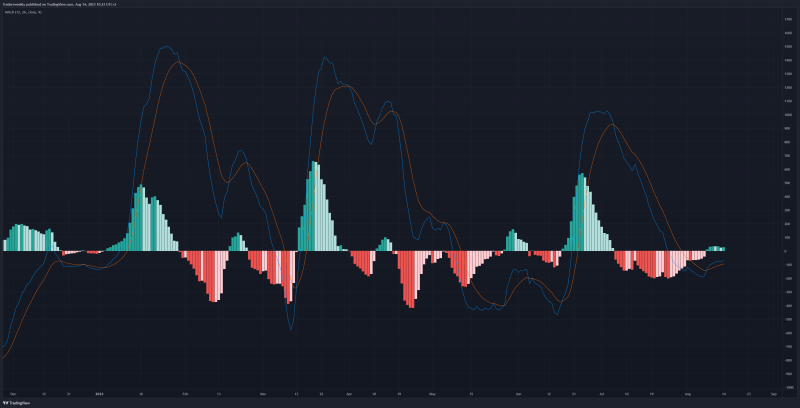

Illustration 1.01

Illustration 1.01 displays the daily chart of MACD. If MACD fails to break above the midpoint, it will be bearish for BTCUSD in the short term. Contrarily, if it manages to do so, it will be bullish.

Technical analysis gauge

Daily time frame = Neutral

Weekly time frame = Slightly bearish

*The gauge does not necessarily indicate where the market will head. Instead, it reflects the constellation of RSI, MACD, Stochastic, DM+-, ADX, and moving averages.

Please feel free to express your ideas and thoughts in the comment section.

DISCLAIMER: This analysis is not intended to encourage any buying or selling of any particular securities. Furthermore, it should not be a basis for taking any trade action by an individual investor. Therefore, your own due diligence is highly advised before entering a trade.