Bitcoin traders are truly “spooked,” and sentiment crashes harder than BTC price as the shake-up from last week’s losses continues.

Bitcoin (BTC) starts a new week with traders licking their wounds after a 10% snap crash.

BTC price action is struggling to recover from a manic end to the week, and the fear is palpable going into what could be an equally volatile few days.

With $26,000 so far forming the focus for the markets, theories are brewing over where Bitcoin might head next.

Multiple factors are set to converge to provide some influence: United States macro data prints are firing up again, while the Federal Reserve will deliver key commentary on the economy at the annual Jackson Hole Economic Symposium.

Within Bitcoin, meanwhile, short-term holders now face increasing unrealized losses, and on-chain transactions in loss are setting multiyear highs.

Sentiment is back on the floor, but is the fear really justified?

Cointelegraph takes a look at these topics and more ahead of what promises to be an interesting week for crypto markets.

BTC order book “ghost town” after OI obliterated

While many expected volatility to kick in around the Aug. 20 weekly close, Bitcoin produced something of a non-event, data from Cointelegraph Markets Pro and TradingView shows, with $26,300 capping the extent of its upside.

A subsequent comedown took the market back to the $26,000 mark, where it traded at the time of writing.

After a week of mayhem, traders and analysts alike remained highly cautious about the outlook, with sources referencing various triggers for new downside.

“Traders still spooked, expecting more downside,” trading suite DecenTrader wrote in an X (formerly Twitter) update on Aug. 21.

Decentrader noted that traders were positioned short across exchanges after a major open interest wipeout during last week’s drop.

“Funding rates continue to be negative,” it added.

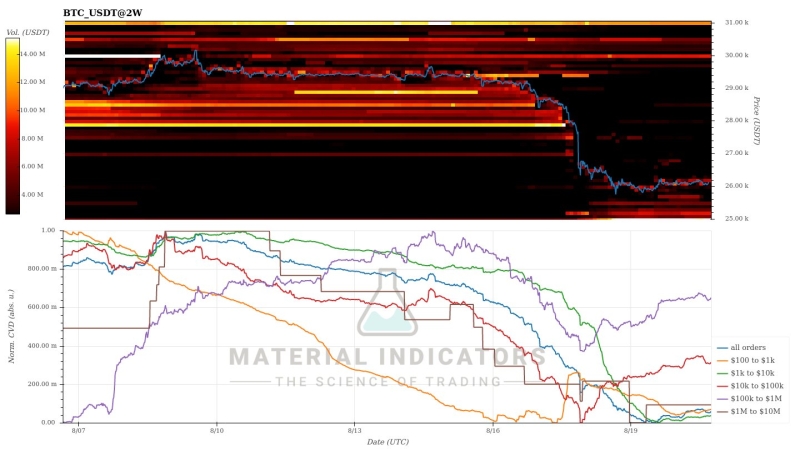

Maartunn, a contributor to on-chain analytics platform CryptoQuant, described Binance order book liquidity as a “ghost town.”

“This will open the door for volatility, in case you’ve missed it,” he suggested, alongside a chart showing liquidity and whale order volumes from monitoring resource Material Indicators.

Maartunn nonetheless reasoned that upside could come as a result, given historical precedent.

“In the entire history of Bitcoin, there were 11 times when Open Interest had a similar decline as three days ago. Among these eleven, eight led to increased prices, whereas three did not,” part of a separate analysis stated.

As Cointelegraph reported, overall long and short liquidations reached levels comparable to the aftermath of the November 2022 FTX implosion.

Bitcoin traders weigh “consolidation scenario”

The quiet weekend gave some traders pause for thought. Bitcoin, they argued, might now open the door to a new phase of rangebound trading.

“Bitcoin fell off back into the previous range. Most likely outcome for next week is to keep trading the range imo,” popular trader CrypNuevo told X subscribers.

Another possible scenario for #Bitcoin is a period of consolidation.

This is not unlikely, as we have witnessed such consolidation multiple times in the past following significant market movements.https://t.co/pfl62msjJm pic.twitter.com/1jeRb6eJfL

— Maartunn (@JA_Maartun) August 20, 2023

On weekly timeframes, trader Skew outlined upside, downside and consolidation scenarios all being possible.

“Consolidation scenario is chopping between $25K & $30K ~ long term range,” he confirmed alongside an illustrative chart.

Key timing for Powell’s Jackson Hole speech

While last week was quiet in terms of U.S. macroeconomic data releases, the coming five days promise a change of tempo.

U.S. jobless claims will hit on Aug. 24, with home sales and other data preceding them.

“Volatility is officially back,” financial commentary resource The Kobeissi Letter summarized to X subscribers.

Key Events This Week:

1. Existing Home Sales data – Tuesday

2. US Services PMI data – Wednesday

3. New Home Sales data – Wednesday

4. Core Durable Goods data – Thursday

5. Initial Jobless Claims – Thursday

6. Fed Chair Powell Speaks – Friday

Volatility is officially back.

— The Kobeissi Letter (@KobeissiLetter) August 20, 2023

Traders and analysts, however, have their eyes mostly set on Jerome Powell, chair of the Federal Reserve, who will take to the stage at the annual Jackson Hole Economic Symposium on Aug. 25.

Jackson Hole is a classic venue for market volatility, and given the current climate, this year’s event should be no exception.

“The Fed’s annual Jackson Hole meeting is more important than ever this week,” Kobeissi added.

Powell will be joined by speakers such as Christine Lagarde, president of the European Central Bank.

With both the Nasdaq and S&P 500 joining crypto in a week of losses, historical patterns could still turn the tables as Jackson Hole traditionally provides risk-on relief.

Popular trader and analyst Miles Johal was also hopeful, stating that, unlike stocks and Bitcoin, U.S. dollar strength faced an uphill struggle.

“SPX – Uptrend, at support and oversold. BTC – Uptrend, at support and oversold. DXY – Downtrend, at resistance and overbought. US10Y – Double top pattern, at resistance and overbought,” he explained to X subscribers.

All #BTC pullbacks in 2023:

• Early February -12%

• Late February -22%

• March -9%

• April to June -20%

• July to August -12%$BTC #Crypto #Bitcoin pic.twitter.com/4pmBXPY0fp

— Rekt Capital (@rektcapital) August 17, 2023

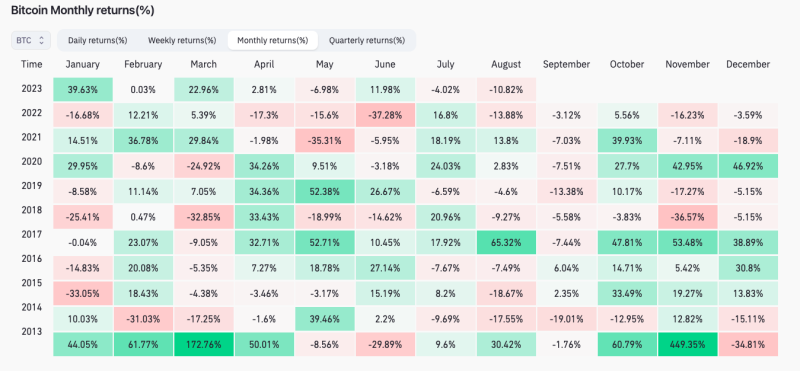

Data from monitoring resource CoinGlass puts August 2023 losses at -10.8% as of Aug. 21.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.