XRP whales are accumulating again, but that’s not all that is happening.

Edited By: Jibin Mathew George

- XRP’s dominance and monthly volatility say price is set to go higher

- XRP’s monthly MACD indicator turned bullish as whale accumulation intensified

XRP‘s price action is worth watching, especially after recent SEC developments suggested that it may be poised for significant moves on the charts soon.

Consider this – The Bollinger Bands on the monthly chart were tightening at press time, signaling that XRP is in consolidation right now.

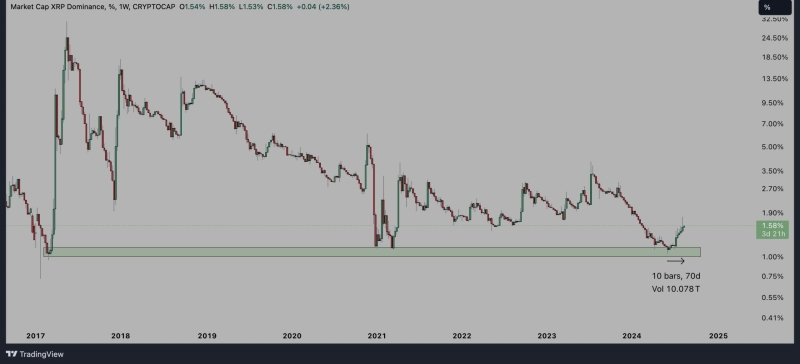

When considering XRP’s dominance chart to cut through the noise of XRP/USD, however, it showed clear market outperformance, reversing from levels that typically precede major rallies.

With monthly volatility at an all-time low and these indicators revealing a bottom, XRP may soon be ready to rise. If this is the case, it might be one of the most promising altcoins in the market in the short-term.

Additionally, XRP’s weekly timeframe has outperformed the market for 10 consecutive weeks – A sign of strong potential for an upward breakout in XRP/USD’s charts.

Despite the current stagnation of XRP/USD, XRP’s total market cap indicated strength that is both undeniable and sustainable. Simply put, this consistent outperformance suggested that XRP may be well-positioned for future gains, supported by strong market metrics.

MACD indicator analysis flashed green

XRP, at the time of writing, was in a Wave 3 structure on the monthly timeframe, targeting $1.88, $5.85, $18.22, and $36.76 by Wave 5 as Dark Defender cited on X.

Once XRP breaks above $0.66, a quick move to $1.03 can be expected, marking a mid-level target. Holding above $1.03 would mean an extremely bullish zone above the Ichimoku Clouds.

Also, yhe MACD Monthly Indicator also turned bullish, while the formation of a Dragonfly Doji suggested greater buying pressure.

Considering these technical indicators and the influence of recent SEC developments, XRP may be poised to reach these anticipated targets.

Whales accumulate as funding rates bleed

Here, it’s also worth pointing out that whale activities surged after a large XRP holder recently added 7.0 million XRP, worth $4.1 million, to their holdings from UPBIT within 24 hours. This action brought their total XRP stash to 5.553 million XRP, valued at $3.25 million.

Such a significant whale accumulation is a sign of a potential bullish move for XRP, indicating that the price may rise in the coming months. Especially as major investors continue to load up their XRP holdings.

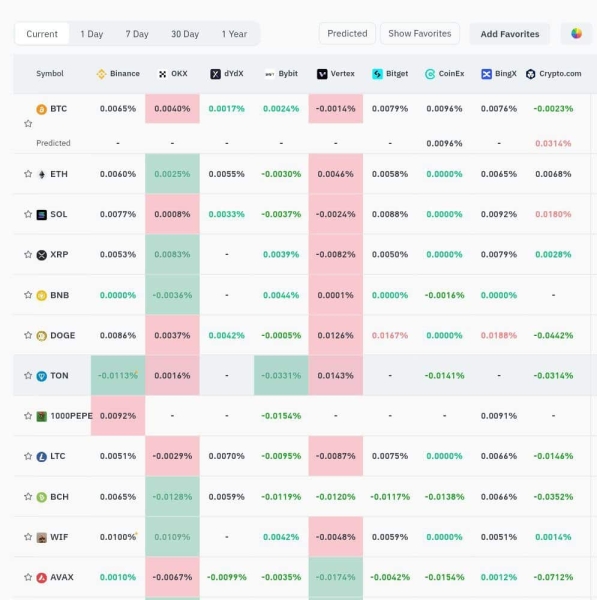

Finally, negative crypto funding rates signalled a prime buying opportunity. With more positive indications, XRP’s dominance is set to grow, potentially driving its price higher and making it a strong investment in the coming months.