The exchange faces ongoing rumors about its stablecoins reserves and an alleged investigation by Chinese authorities.

Cryptocurrency exchange Huobi has seen outflows worth $64 million between Aug. 5-6, amidst ongoing rumors about its solvency and that Chinese authorities were investigating its executives. Outflows over the weekend resulted in the exchange’s total value locked (TVL) falling to $2.5 billion at the time of writing, down from $3.09 on July 6.

Rumors that the exchange’s leadership had been arrested in China first surfaced on Aug. 4, as part of an alleged investigation about the exchange’s dealings with gambling platforms. Speaking to Cointelegraph, a Huobi spokesperson labeled the claims as fake news. Rumors surface as authorities are reportedly tightening up control over cryptocurrency exchanges in mainland China.

Cointelegraph has learned that at least one C-level executive has left Huobi over the past few weeks, although it’s unclear whether the departure is connected to investigations in China. On social media platform X (formerly Twitter), Huobi’s head of social media said the rumors are untrue and that the exchange is “currently doing well”.

The source has been verified as a senior executive at Tron who has first hand knowledge of the investigation and has been at Tron for many years.

Whether you’ve been informed or not, your colleagues are currently under criminal investigation.

— Adam Cochran (adamscochran.eth) (@adamscochran) August 6, 2023

The crypto exchange allegedly faces solvency issues as well. Fintech executive and angel investor Adam Cochran noted in a series of posts that the firm could be insolvent due to inconsistencies in its Tether (USDT) holdings.

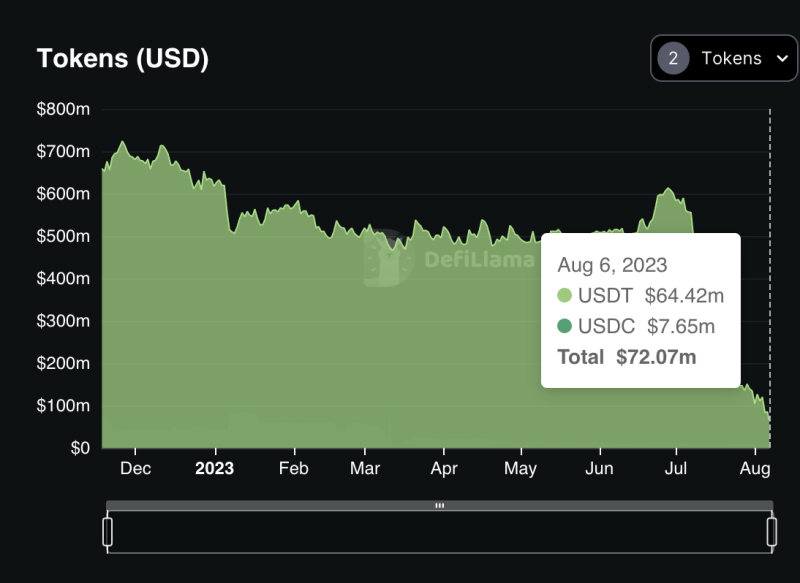

Supported by on-chain data available on DeFiLlama, Cochran pointed out that across USDT and USD Coin (USDC) combined, Huobi held less than $90 million of assets on Aug 5. The exchange’s latest ‘Merkle Tree Audit’, however, lists that “Huobi users have $630M in USDT held and a wallet balance of $631M USDT,” reads the thread. According to Cochran, “Huobi is deeply insolvent.”

According to DefiLlama data on Aug. 6, Huobi wallets held only $72 million in USDT and USDC combined.

Huobi did not immediately respond to Cointelegraph’s request to clarify rumors of insolvency and discrepancies between on-chain data and its audit report.

Huobi faces challenges in other jurisdictions as well. An enforcement action by the Malaysian securities regulator forced the exchange to close its operations in the country in May.