Amid Ethereum’s ongoing battle to reclaim the $3,000 mark, a noticeable retreat by whale investors hints at underlying market tremors.

Edited By: Ann Maria Shibu

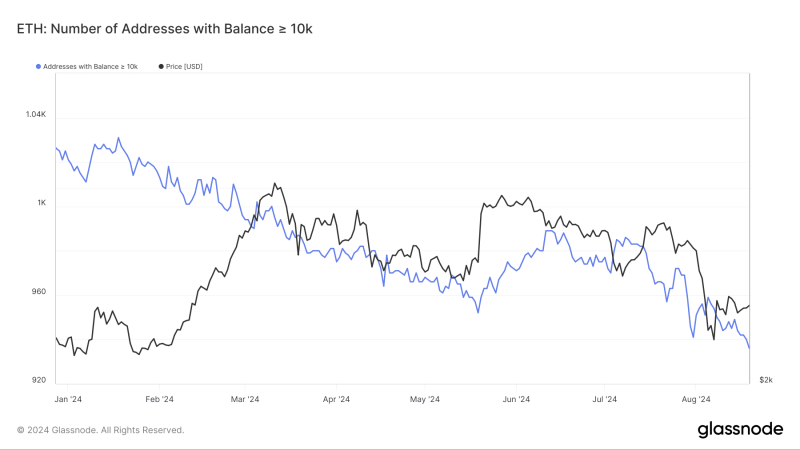

- The number of addresses holding more than 10,000 ETH has declined.

- ETH’s price has been unable to reclaim the $3,000 price level.

The $3,000 price range for Ethereum [ETH] is now beginning to feel like a distant memory as the cryptocurrency continues to struggle to reclaim that level.

Despite attempts to rally, ETH has consistently fallen short, leading to growing concerns among investors and market participants.

Amidst this ongoing struggle, some large holders, often referred to as “whales,” have begun to reduce their holdings.

Ethereum whales reduce holdings

An analysis of Ethereum addresses holding 10,000 or more ETH on Glassnode reveals a significant decline over the past few weeks.

The decline indicates a potential shift in market sentiment among large holders. Throughout 2024, there has been a noticeable decrease in the number of these large addresses, with a particularly sharp drop in recent months.

At the beginning of the year, the number of addresses holding 10,000 or more ETH was around 1,020. However, this figure has steadily decreased, falling below 960 by August 2024, marking the lowest level seen since 2017.

The steady decrease in the number of large ETH addresses could be interpreted as a bearish signal.

When whales begin to offload significant portions of their holdings, it can reflect a lack of confidence in the short to medium-term price prospects of Ethereum.

This trend could indicate that these large holders are either taking profits, reallocating their portfolios to other assets, or preparing for a potential further decline in the market.

Potential impact on the market

As these large holders continue to sell off their ETH, the market may face heightened selling pressure. Without sufficient demand from new buyers to absorb this increased supply, the price of Ethereum could be pushed down further.

On the other hand, if the trend in large addresses begins to stabilize or even reverse, it could signal a renewed accumulation phase among large holders.

This reversal might indicate that these entities believe Ethereum’s price has reached a level where it represents good value, leading to increased buying activity.

Slight puff in the Ethereum price

Ethereum experienced a slight gain in the last trading session, with AMBCrypto’s analysis showing an almost 1% increase.

The increase brought the price to approximately $2,637. As of this writing, ETH continues to trade with an over 1% increase, maintaining its level at around $2,637.

Read Ethereum (ETH) Price Prediction 2024-25

Throughout 2024, Ethereum’s price has seen significant fluctuations. The year began with a strong upward movement, peaking around March.

However, since that peak, its price has gradually declined over the subsequent months. This downward trend has persisted into August 2024, mirroring the decrease in the number of large ETH addresses.