Ethereum (ETH) has so far relatively underperformed in comparison to the flagship cryptocurrency Bitcoin. However, that could change soon enough as a crypto analyst has predicted the second-largest crypto token by market to gain some momentum soon enough.

Ethereum To Hit $1900

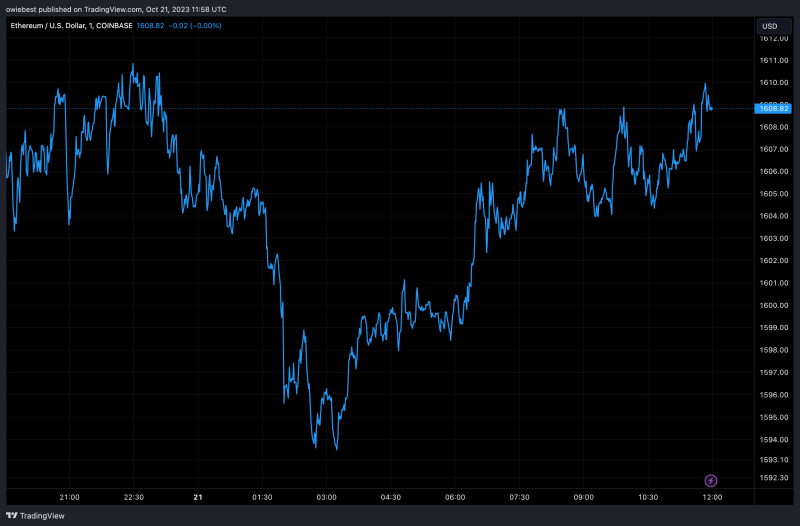

In a post shared on his X (formerly Twitter) platform, prominent crypto analyst Ali Martinez mentioned that Ethereum could rise to as high as $1,900. His prediction was based on data that he had pulled up from the chart which he shared in his post.

The chart (a 3-day timeframe) featured an ascending triangle pattern, which usually represents a bullish formation. According to Ali, Ethereum is “poised” to rebound off the hypotenuse of the ascending triangle. Most importantly, for Ethereum to go as high as $1,900, the analyst noted that It has to experience a “firm close” above the 18-day SMA (Simple Moving Average).

If that happens, Ethereum could hit $1,800 and further rise to $1,900 based on Ali’s predictions. It is worth mentioning that the last time Ethereum hit $1,900 was back in July 2023. A rise to that price again will represent about an %18 increase from its current price of $1,600.

Ali also had something to say about the flagship cryptocurrency, Bitcoin. In a subsequent post, he noted that the crypto token could see a correction to $28,800; a prediction he made based on the TD Sequential from a 4-hour chart.

Bitcoin’s Dominance Is On The Rise

This is significant considering that many speculated that ‘the Flippening’ could happen after the Merge, where Ethereum overtakes Bitcoin to become the most dominant crypto token. However, that hasn’t happened so far, with Ethereum’s move from proof-of-work to proof-of-work being seen as ‘disastrous’ for the crypto token.

Bitcoin and Ethereum, however, share the podium when it comes to the best-performing assets of the year. Both crypto tokens are said to have outperformed the NASDAQ, S&P500, and Gold. Bitcoin has seen an %80 increase year-to-date (YTD), while Ethereum has seen a %35 increase YTD.

Featured image from Analytics Insight, chart from Tradingview.com