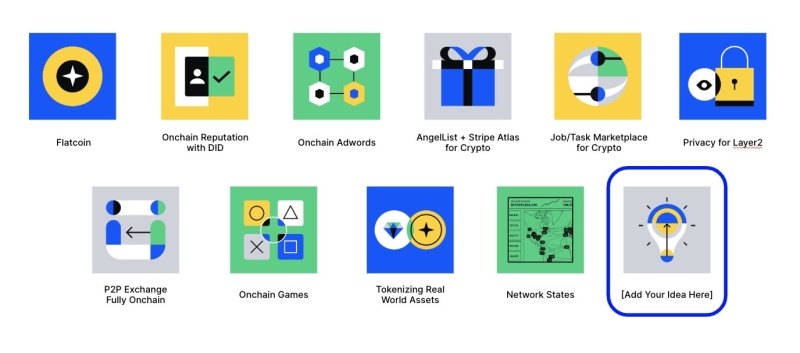

From flatcoins to on-chain advertisements, Brian Armstrong hopes aspiring developers take the time in the bear market to build out these crypto concepts.

Coinbase CEO Brian Armstrong has unveiled the ten ideas he is most excited about when it comes to crypto’s future, sharing hopes that developers can use the bear market to take them to the next level.

The Coinbase boss shared his vision of a crypto future in an Aug. 30 company blog post and presentation, sharing the concepts he believes have the potential to make it in the digital asset industry.

“I decided to share my 10 top ideas with the hope that someone goes out and builds them,” he said before adding, “Ideas are cheap.”

1/ I'm sharing the 10 ideas I'm most excited about in crypto right now. If you're building something in crypto or thinking about doing so – check it out.

We’re building lots at Coinbase, but we don't have time to tackle everything. So I figured I'd share these. Bear markets are… pic.twitter.com/XKzCkMaOOT

— Brian Armstrong (@brian_armstrong) August 30, 2023

One of the first concepts he discussed was a “flatcoin” — a decentralized stablecoin that tracks inflation to preserve purchasing power, which could be backed by a basket of assets or use an algorithmic approach.

Armstrong cited services like Ampleforth and Truflation, which “offer a way to potentially track inflation on-chain today, to further decentralize it.”

He said something like this was necessary because people are reluctant to spend Bitcoin, and fiat-backed stablecoins “suffer from inflation and seizure — just like fiat money.”

Another concept was “on-chain reputation” — a system that assigns reputation scores to wallet addresses or ENS names based on on-chain activity. It would be similar to Google’s PageRank and used for lending, ratings, and fraud prevention.

Armstrong also highlighted the potential of “onchain ads” — the Web3 version of adverts that would pay out based on on-chain actions as opposed to Web2 ads that are view or click-based. They could have smart contracts that can specify payouts and wallets that can choose which ads to show.

“Onchain capital formation” — another idea — was described by Armstrong as a concept that democratizes fundraising, helping the next iteration of ICOs and startups raise money on-chain in a compliant and trusted way.

Armstrong acknowledged the ICO frenzy happened for a reason, stating, “capital formation globally is still way too high friction,” before adding:

Armstrong’s sixth idea was “privacy for layer 2,” which brings private transactions to L2 instead of having them only on public blockchains.

“There are many cases where transparency is a feature, but people do not want most transactions in the economy to be public,” he said.

Other ideas included a fully on-chain peer-to-peer exchange, on-chain games with asset ownership and more real-world asset tokenization.

On-chain games are already a live concept in crypto that lets players truly own in-game assets as NFTs, creating economies and metaverse worlds. Real-world asset tokenization — such as stocks, commodities, real estate, and other assets is also already used around the world

A recent report from Boston Consulting Group expected the tokenization of illiquid assets to grow into a multi-trillion-dollar sector over the next few years.

Armstrong’s final idea was “Software for Network States” which are tools to help startup cities and communities manage governance, voting, taxes, and services, on-chain.

“In five years, many entrepreneurs will be looking back wishing they had started a crypto company in 2023,” he said, before concluding that “Bear markets are for building.”

Coinbase has been gearing up for its inaugural Coinbase Ventures Builder Summit in California in October and Armstrong’s recent public appearance could be an attempt to spark interest for it.