Listen this article

download

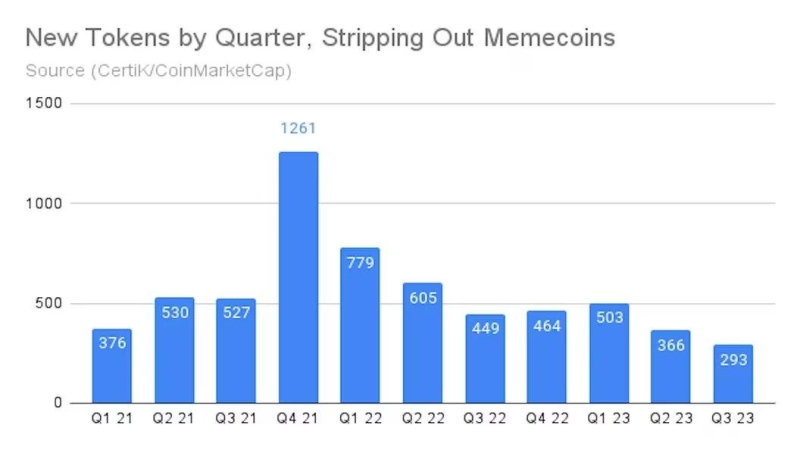

According to an analysis conducted by smart contract auditor Certik, based on data collected by CoinMarketCap, we are in a discouraging phase on the new crypto creation front.

Indeed, fewer crypto tokens, excluding memecoins, were created in Q3 2023 than in the previous quarters of the past 3 years.

Specifically, in July, August, and September 2023, only 293 new crypto assets were brought to market, which is less than a quarter of what was recorded during the height of the 2021 bull market.

Factors disincentivizing this practice are the low liquidity of money in the market and the presence of hostile regulations in several countries around the world.

See all the details below.

Certik’s analysis of CoinMarketCap data: few new crypto assets created in Q3 2023

Certik, a well-known auditing company that focuses on smart contract security, analyzed a dataset provided by CoinMarketCap, revealing that very few new crypto assets were created in Q3 2023.

In fact, we are at the lowest level in 3 years, with market participants finding themselves discouraged to risk issuing a new crypto token in the absence of favorable market conditions.

According to data from Certik and CoinMarketCap, only 293 crypto assets were created in the last quarter, a number that is a quarter of what it was in the last quarter of 2021 at the height of the bull market.

Since early 2022, this trend has been consistently downward, with a tentative hint of an upturn in the first quarter of 2023, motivated by the rally in Bitcoin and the crypto market, which recovered several percentage points after a year-long dump.

Usually, the frequency with which new tokens are created goes hand in hand with the positive performance of the crypto market: when Bitcoin and altcoins perform well, users are incentivized to risk capital by inventing their own coin.

The penultimate quarter of 2023 ended with one of the lowest liquidity levels in recent years, with several market makers deciding to stop their money flows to crypto markets.

Many blockchain companies have even made heavy staff cuts, such as Opensea, which recently laid off about 50% of its staff, to cope with the pitfalls of the crypto winter.

When the market is not going well, the fomo from generating new tokens goes down.

In this regard, Sean Farrell, crypto analyst at independent investment research firm FundStrat said:

“No one wants to price a token when there is a lack of risk-taking.”

The regulatory factor may also have played a role in the decisions of users in the crypto world.

Certik and Coinmaketcap revealed that several interviewees felt uncomfortable with the SEC’s launch of a series of lawsuits against major crypto market players.

In an environment where market regulators are pressuring exchanges by accusing them of selling unregistered securities, it is clear that there is less appetite to launch a token that will likely be labeled as security.

At this exact moment, however, it seems that all the problems are slowly fading away: Bitcoin is pumping back into the market, liquidity and trading volumes are picking up, and the SEC is losing all its cases against Grayscale, Ripple and company.

Probably, given the current conditions, a significantly higher number will be observed at the end of Q4 2023 than in the previous month regarding the creation of new decentralized currencies.

The crazy trend of new memecoin creation

As mentioned earlier, Certik’s analysis based on CoinMarketCap data, does not take into account the avalanche of memecoins that are being created every day thanks to the imagination and resourcefulness of the crypto community.

When it comes to meme-based tokens, the numbers change drastically: while for more serious cryptocurrencies with an honest project behind them, the process of getting them to market is decidedly more complex, in this case the process of creating a virtual asset becomes much more streamlined.

Usually, serial memecoin creators are just waiting for the market to ride a new narrative that generates hype or for Elon Musk to make one of his wacky posts on X, so that they can launch a crypto that picks up on certain viral words or symbols.

For example, during the explosion of the chatGPT fad, hundreds and hundreds of coins were created that featured words like “AI,” “OpenAi,” “GPT,” etc. within their names.

A few days ago, however, after Elon Musk unveiled his new artificial intelligence system “Grok” that connects to X’s dataset, an inordinate amount of tokens with the same or similar words such as “GrokAi,” “Grok 2.0” “ElonGrok” “DGrok” “Grok-0” etc. appeared in the crypto markets.

The most famous one, which is simply called “GROK” has attracted a lot of public attention, to the point that it is even listed on a couple of centralized exchanges.

Its marketcap has reached $22 million and there are already 6,300 holders who have bought memecoin

Those who create one of these crypto memes focus on only two distinct elements: name search and placing initial liquidity to incentivize free exchange on DEX.

There are no issues related to the future of regulation, the macroeconomic situation of the markets, or the price performance of Bitcoin: 99% of these crypto assetss are created with the intent of making an easy profit in the immediate term, with no prospect of growing or actually bringing anything to investors.

Usually a memecoin lasts a few days before its founders make a rugpull or its price goes to zero, hence precisely why it is important to ride a momentary trend rather than thinking about the future stability of one’s ecosystem.

When trading these currencies, it is always good to be cautious and consider that what you are buying represents neither more nor less than mere garbage.

Although you can make very high percentage gains in a short time, there is a need to remember that the risk of scam is just around the corner, and could cause you to lose your entire “investment”