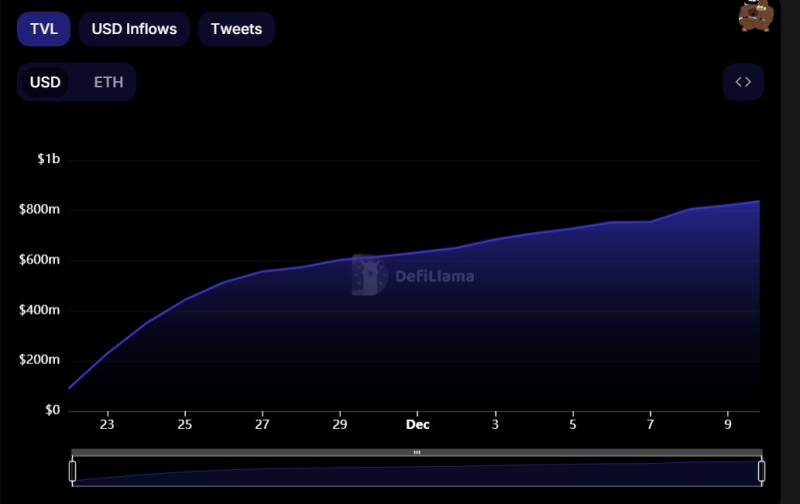

Ethereum layer-2 protocol Blast has hit a new All-Time High (ATH) in its Total Value Locked (TVL) which topped $835 million recently PromotedAd $PIKA – Fastest-growing GameFi token. Join the Presale Now! Pikamoon ($PIKA) – Join the Presale Now! By Godfrey Benjamin 2 hours ago Updated 2 hours ago

According to data from DefiLlama, Ethereum Layer-2 network Blast has hit a new milestone in terms of its Total Value Locked (TVL) in just a few weeks after its controversial launch.

Blast TVL Jumps 26.6%

The data showed that Blast’s TVL is currently at $835.88 million and has seen a 26.5% gain in the past seven days. About two weeks ago, the L2 solution had a TVL of just around $300 million based on DefiLlama’s data. The sporadic growth is an indication that the Web3.0 protocol has gained significant traction in the Decentralized Finance (DeFi) ecosystem.

Blast TVL Chart. Source: DeFiLlama

A largest percentage of its growth is attributed to the unique business model it adopted. The platform, created by Tieshun Roquerre, known as ‘Pacman’ and founder of the Non-fungible token (NFT) marketplace Blur, utilizes a unique yield generation model for users who stake their funds, whether in Ethereum or stablecoins.

On Ethereum staking, users are promised as high as a 4% yield while stablecoins stakers stand to get a 5% yield. The uniqueness of this feature has gone a long way in attracting significant investor attention, especially as it is a fresh concept in the DeFi landscape.

The evidence of this affinity is the surge in the Blast TVL.

Best Crypto Exchanges and Apps September 2023 Must Read Top Meme Coins to Buy Now: What You Need to Know Must Read Top 10 Web3 Games To Explore In 2023; Here List Must Read

Upgrade Expected Amid Security Concerns

This growth does not to overlook the challenges that the protocol has had in this short time of its launch. By the end of November, a security concern arose after users staking on Blast saw $100,000 disappear after the deposit was converted to Dai (DIA).

It turned out that the issue was as a result of a misconfigured slippage parameter on the user interface. This continued with about $350 million in assets converted to USDT and ETH as well.

However, Blast was quick to address this issue, emphasizing the need for upgradeable contracts, which, despite potential vulnerabilities, offer adaptability in response to exploits. There were concerns that this would impact negatively on the protocol adoption but the current Blast TVL claim otherwise.

Meanwhile, cryptocurrency veteran Dan Robinson, General Partner and the Head of Research at heavyweight crypto VC Paradigm, with a deep stake in Blast, hinted at an upgrade in Blast’s technical design scheduled to happen next week.

The upgrade is open-source and is free for anyone who plans to explore its usage.