BTC price weakness clearly makes speculators nervous as single-day selling pressure hits its highest since after the Terra LUNA collapse.

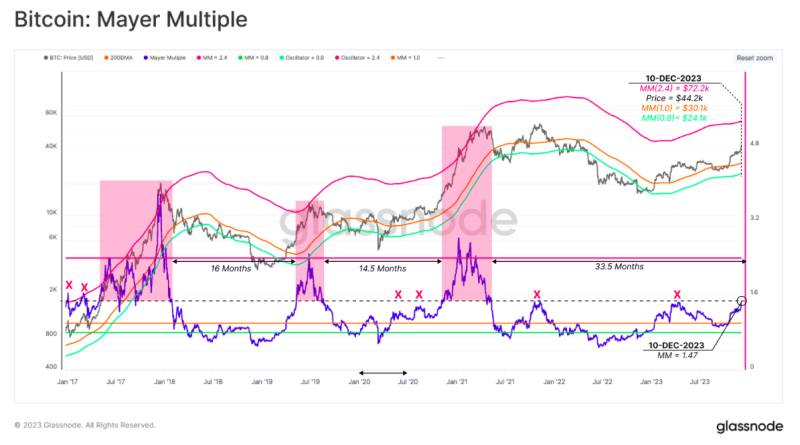

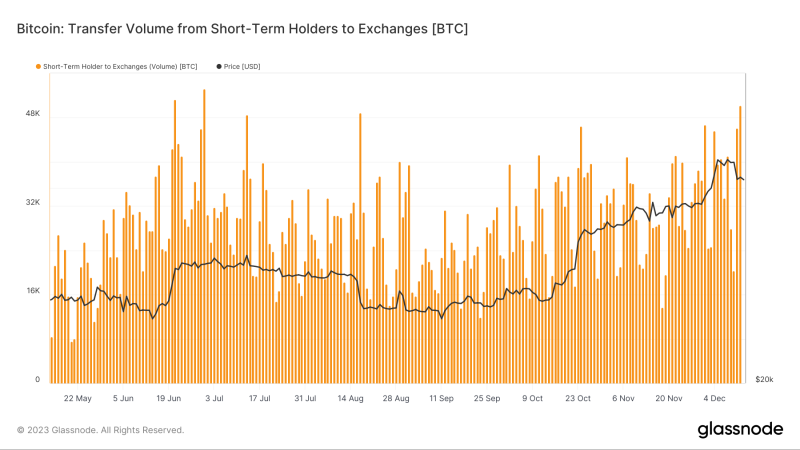

972 Total views 23 Total shares Listen to article Bitcoin (BTC) speculators panic sold as the BTC price corrected toward $40,000, the latest on-chain data suggests. Figures from on-chain analytics firm Glassnode show short-term holders (STHs) offloading more than $2 billion in BTC on Dec. 12 alone. Bitcoin saw its biggest single-day drop of 2023 this week — one which at one point totaled 8.1%, data from Cointelegraph Markets Pro and TradingView confirms. Reacting, the more speculative subsection of the Bitcoin investor base followed in step, reducing their exposure in what appears to be a bout of cold feet on the market outlook. Glassnode reveals that STHs, which constitute entities holding BTC for 155 days or less, sent $1.93 billion worth of coins to exchanges on Dec. 11, followed by another $2.08 billion the day after. Both days mark long-term highs in terms of STH selling pressure, with entities both in profit and loss joining the trend. The last time single-day selling passed the $2 billion mark was in June 2022 — a reaction to the impending collapse of blockchain firm Celsius. In a post on X (formerly Twitter) on Dec. 12, James Van Straten, research and data analyst at crypto insights firm CryptoSlate, noted the significance of the week’s STH movements. “$2B in total, with $1.1B in loss,” part of his commentary stated. “That is for anyone who bought between Dec. 6 and Dec. 13, most likely retail, after seeing Bitcoin up 150% YTD.” In BTC terms, volumes were less sizable, with the Dec. 12 tally marking the largest since the start of July this year. At the time, BTC/USD was fresh from a rebound above the $30,000 mark after dipping to $25,000. Continuing, Glassnode flagged multiple on-chain indicators suggesting that STHs may have had their fill of the bull mark for the time being. Profit-taking around this month’s 19-month highs near $45,000 was “meaningful,” researchers said, adding that “potential saturation of demand (exhaustion) may be in play.” “After such a powerful 2023 thus far, this rally in particular seems to have met resistance, with on-chain data suggesting STHs are a key driver,” they wrote in part of a conclusion to the firm’s latest weekly newsletter, “The Week On-Chain,” released Dec. 12. Among the indicators featured was the Mayer Multiple, which describes the relationship of current spot price relative to its 200-week moving average. The Multiple is fast coming up to 1.5 — an area which, while not “overbought,” has acted as bull market resistance during Bitcoin’s history. “The present value of the Mayer Multiple indicator is at 1.47, close to the ~1.5 level which often forms a level of resistance in prior cycles, including the Nov 2021 ATH,” Glassnode explained. “Perhaps as an indicator for the severity of the 2021-22 bear market, it has been 33.5-months since this level was breached, the longest period since the 2013-16 bear.” This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. Bitcoin short-term holders set 18-month selling record

Mayer Multiple shows classic resistance looms