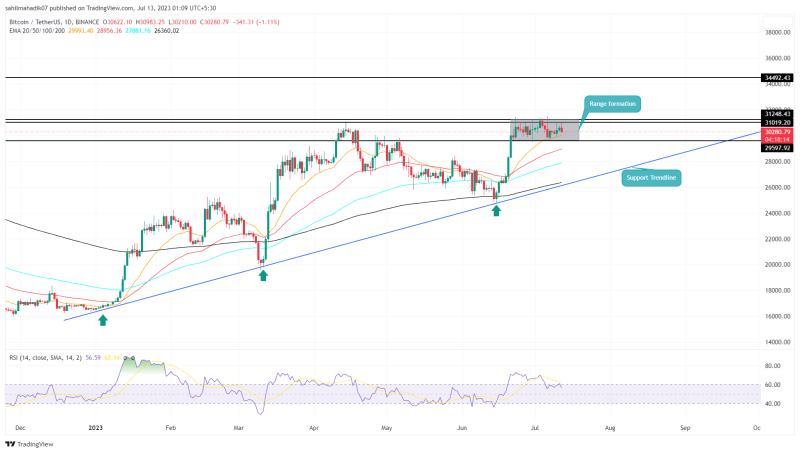

Over the past three weeks, the largest cryptocurrency-Bitcoin has remained sideways and traded strictly between $31450 and $29600 levels. While a consolidation after a bullish rally is considered preparation for the next leap, the sideways action has prolonged enough to consider the market sentiment is uncertain. Thus considering the aforementioned zone as a no-trading area, the potential target must wait for a breakout.

Also Read: Bitcoin (BTC) Set For $35000, Ethereum (ETH) Above $2000 As US CPI Inflation Falls

Bitcoin Price Daily Chart

- The rejection candle near $31450 indicates the sellers continue to defend this resistance

- The potential buyers can look at the entry for $31200 or a retest to the rising trendline.

- The intraday trading volume in Bitcoin is $14.5 Billion, indicating a 7.5% loss.

Source-Tradingview

By the press time, the Bitcoin price trades at $30629 and with an intraday loss of 0.2% projects another reversal from the range resistance. A high wick rejection attached to the daily indicates the overhead supply pressure is intact, the ongoing consolidation phase could prolong.

The potential reversal could plunge the BTC price by 3.3% to revisit the $29600 support. Thus, a decisive breakout from the range barriers is crucial to determine the upcoming price trend.

A breakdown below the $29600 support may trigger a longer correction in Bitcoin price and retest $27500 aligned with the rising support trendline. The coin holders can use this trendline as a trailing stop loss to ride this recovery rally longer.

What if Bitcoin Breaks the $31450 Barrier?

A bullish breakout from the $31450 resistance with daily candle closing will release the trapped bullish momentum and set Bitcoin price for further rally. The newly reclaimed support could offer a solid launchpad and drive a rally 10% higher to hit $34500.

- Exponential Moving Average: The 20-day EMA slope as dynamic support could project an additional push for an upside breakout.

- Relative Strength Index: A falling RSI slope reflects the sellers are getting nullified as the price holds into higher levels and maintains a sideways trend.