Bitcoin price closed another weekly below bull market support. 10x research revealed that BTC buy & hold strategy no Longer working. By Varinder Singh 2 hours ago Updated 1 hour ago

Highlights

- Bitcoin bulls are struggling against bears as sentiment dropped to extreme fear.

- Benjamin Cowen pointed out bearishness as BTC closed below its bull market support band for another week.

- 10X Research reports that the traditional buy-and-hold strategy is no longer working for investors.

Bitcoin bulls are struggling against bears as the crypto market sentiment index slipped to extreme fear. Traders are bullish on crypto market recovery overall after favorable US economic data, but technical weakness puts pressure on Bitcoin price.

Bitcoin Price Trades Under Bull Market Support

Bitcoin fell more than 2% in the last 24 hours and the price hit a low of $58,210. Meanwhile, altcoins such as Ethereum, Solana, XRP, and Toncoin witnessing upside momentum. This hints at a potential entry into the altcoin season, but its unclear from other indicators.

Into The Cryptoverse founder Benjamin Cowen pointed out that Bitcoin saw another weekly close below its bull market support band. This puts a pause in the bullish momentum as traders become cautious and evaluate their investment strategies. Notably, Bitcoin price has also trading below the key 200-SMA.

August has been the worst month for BTC historically and the recent price action proves the trend is also continuing this year. However, the recent cooling CPI inflation, lower jobless claims, and retail sales data have put interest rate cuts by the US Federal Reserve on the table. It will likely bring a rally in Bitcoin price.

Best Crypto Exchanges and Apps September 2024 Must Read Top Meme Coins to Buy Now: What You Need to Know Must Read Top 10 Web3 Games To Explore In 2024; Here List Must Read

Analyst Says BTC Buy & Hold Are Not Working Anymore

Markus Thielen, a top analyst and CEO of 10X Research, the traditional buy-and-hold strategy is no longer working for investors. He believes there is still significant upside left despite Bitcoin’s recent loss of momentum.

Until now, August has recorded $320 million in spot Bitcoin ETF outflows, second after $345 million outflows in April. Bitcoin ETF inflows in the last two days signaled high odds of a bullish reversal. This week will be crucial due to FOMC Minutes release, Fed Chair Jerome Powell’s speech, and jobless claims.

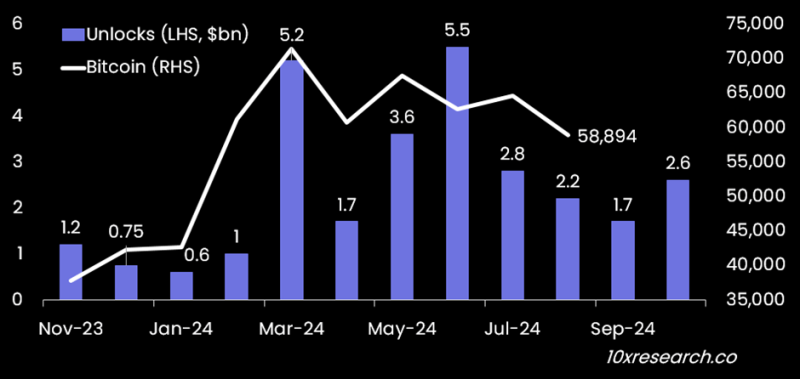

As per 10x Research, the only strategy that seems to work right now is identifying the trend in token unlocks vs Bitcoin. Should traders switch to this strategy amid Bitcoin price volatility in this bull market?

BTC price is trading at $58,507, down 2% over the last day. The 24-hour low and high are $58,264 and $60,262, respectively. Furthermore, the trading volume has increased by 35% in the last 24 hours, indicating a rise in interest among traders.