Bitcoin erases all trace of “Grayscale hype,” with September offering a trip below $26,000 and limited chance of upside, BTC price analysis warns.

Bitcoin (BTC) fell further after the Sept. 1 Wall Street open as monthly close losses continued to play out.

BTC price “Grayscale hype” disappears

Data from Cointelegraph Markets Pro and TradingView followed weakening BTC price performance, which hit its lowest since Aug. 22.

Bitcoin bears took full advantage of the August monthly close, with downside volatility characterizing Bitcoin and crypto markets overnight.

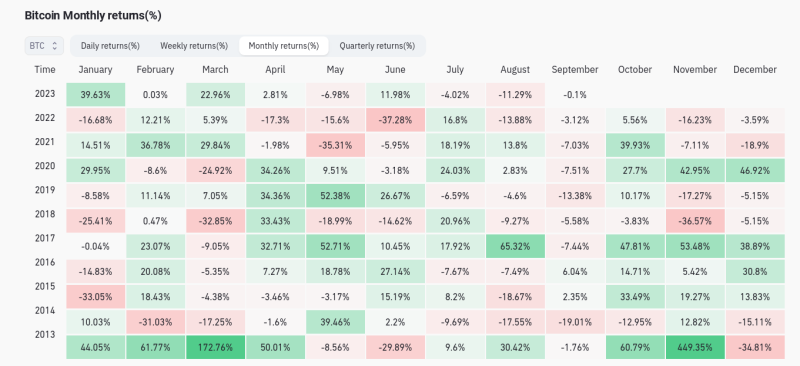

Overall, BTC/USD lost 11.2% in August, and looking ahead into September, there was little optimism regarding a rebound among market observers.

In his latest YouTube update, popular trader and analyst Rekt Capital delineated Bitcoin’s potential next steps.

BTC price had failed to hold on to gains coming courtesy of “Grayscale hype,” he said, with selling pressure strong and weekly relative strength index (RSI) values dropping toward a key rising trendline.

A cluster of exponential moving averages (EMAs), previously acting as support, were also now flipping to resistance.

“We’ve seen for a very long time, multiple months — over a year now, actually — that this trendline is holding, and if we lose this RSI trendline, we’ll probably see further downside,” Rekt Capital explained.

Targets for a fresh drop lay at various points on the way to $23,000, now a favorite among traders.

“Somewhere between 7% and 13% should be reasonable” for September losses based on historical norms, he added, referencing data from on-chain monitoring resource CoinGlass.

Should a relief rally occur, Rekt Capital continued, this could top out at $27,200 — a line in the sand that used to act as support.

U.S. dollar strength retests June highs

Bitcoin’s performance was not helped by a second day of solid upside for U.S. dollar strength.

The U.S. Dollar Index (DXY) was above 104 at the time of writing, having made up for recent losses and apt to continue an uptrend that began in mid-July.

A previous local high in June acted as resistance upon a retest in August, with this now the level of interest.

Market participants are split over the current role of the DXY’s strength in suppressing BTC price, with an inverse correlation between them repeatedly challenged over the past year.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.