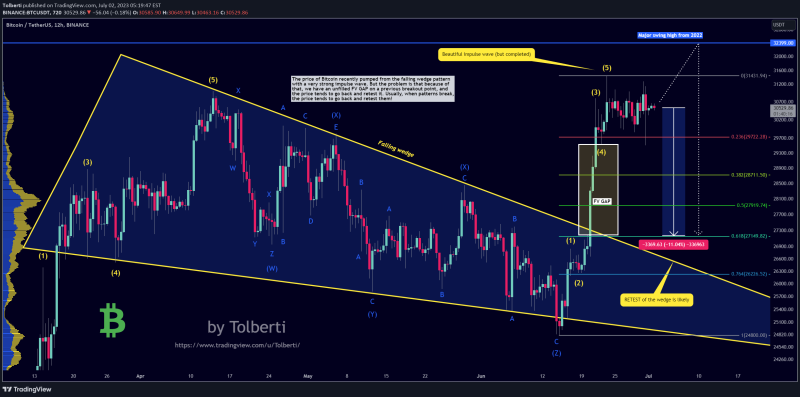

- The price of Bitcoin recently pumped from the falling wedge pattern with a very strong impulse wave. But the problem is that because of that, we have an unfilled FV GAP on a previous breakout point, and the price tends to go back and retest it. Usually, when patterns break, the price tends to go back and retest them!

- In this case, we can completely retest the wedge at the trendline (which will be a deep retracement) or retest the breakout point of the wedge and fill the FB GAP. In the confluence, we have the 0.618 Fibonacci retracement of the impulse wave, giving us a pretty good long trade with a solid risk-to-reward ratio.

- We are going to go down sooner or later; the probability of it is actually very high. But there is also a chance of going higher to 32399 first to take the liquidity above the previous swing high from 2022 before retesting the wedge!

- It was a huge pump, and buying or speculating on price increases is very risky. I would not do that at all, so rather prepare your shorts at higher prices or at confirmation of the downtrend!

- From the Elliott Wave perspective, I can already see a completed impulse wave that screams for a retracement. The trendline of the impulse wave is broken, and we could definitely go down next week!

- This analysis is not a trade setup; there is no stop-loss, entry point, profit target, expected duration of the trade, risk-to-reward ratio, or timing. I share my trades transparently and post trade setups privately.

- Thank you, and for more ideas, hit “Like” and “Follow”!

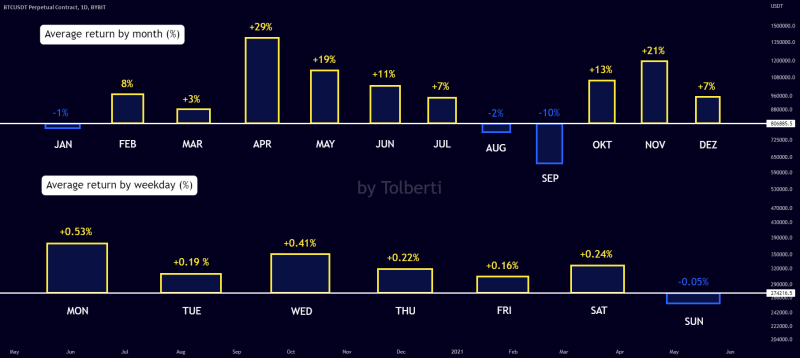

Comment: Another reason why Bitcoin could crash in August / September is this chart. These months are usually very bearish for the price of Bitcoin. Do your own research, but I am giving you the most relevant technical analysis as always!

Comment: The price action starts to look similar to before.

The price pumped with a strong wave, then consolidated and made a bull trap final trend, followed by a crash. Something similar is definitely on the table: