Though BTC climbed to $51,000, macroeconomic factors may pull the price back going forward.

Edited By: Ann Maria Shibu

- The CPI came out at 3.1%, triggering a price decrease for Bitcoin.

- If interest rates remain unchanged by March, BTC might fall below $50,000 again.

The Consumer Price Index (CPI) reading released on the 13th of February did not go down well for Bitcoin [BTC]. Before the report was released, participants had expected the CPI to come out at 2.9%. But AMBCrypto discovered that the Bureau of Labor Statistics set the benchmark at 3.1%.

A higher-than-anticipated result meant that nominal rates were higher which made it difficult for investors to consider BTC as an urgent store of value. For the unaccustomed, the CPI is a measure of the aggregate price level in an economy.

When it decreases, it means consumer prices are generally falling, and the market can get more liquidity.

The store of value can wait

However, a high CPI suggests an increase in prices. Therefore, investors might not consider buying cryptocurrencies as an emergency decision.

Following the report, Bitcoin’s price fell from $50,000. This decrease could be linked to the possibility that some market players took profits since they would need more funds for “in real life” activities.

Despite the decline, AMBCrypto noticed that participants remained hopeful that BTC’s short-term potential might remain bullish.

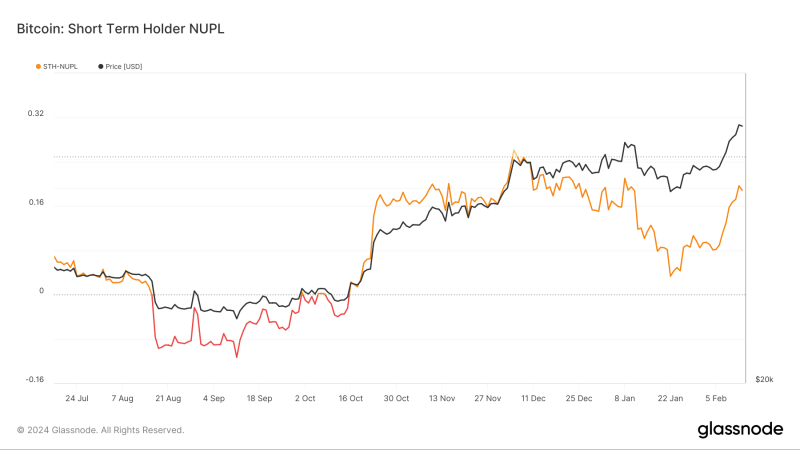

One metric that explains this is the Short Term Holder- Net Unrealized Profit/Loss (STH-NUPL). This metric considers only UTXOs younger than 155 days and serves as an indicator to assess the behavior of short-term investors.

From the chart above, Bitcoin holders have moved on from capitulation (red). Also, the hope (orange) that the price would improve was solid. Should this continue, investors’ behavior might move to optimism (yellow).

March might either make or break BTC

Another major meeting that could affect Bitcoin’s price going forward is the FOMC. The FOMC stands for Federal Open Market Committee. It is a division of the U.S. Federal Reserve that focuses on setting monetary policy by managing open market conditions.

Some weeks back, AMBCrypto reported how the Fed Chair Jerome Powell predicted that the Fed might not cut interest rates by March. A more recent development driven by the CME Group revealed that the probability of keeping interest rates the same has increased to 92%.

The derivatives marketplace also noted that the probability of cutting interest rates was 62.1%. If By March, the FOMC decides to cut rates, Bitcoin’s price might soar higher. But if the rates remain unchanged, the value might either decrease or consolidate.

In the meantime, on-chain data from Santiment showed that BTC was closing in on a return to $50,000. The post mentioned that the disappointing CPI outcome put traders in panic. But now, market participants were taking positions for further climb.

Is your portfolio green? Check the BTC Profit Calculator

If Bitcoin reclaims $50,000, then major altcoins might also rebound. Should this be the case, BTC might try and test $55,000 while a widespread altcoin rally might begin.