In the previous article, we reiterated our belief that Bitcoin is headed lower. Today, we still hold this opinion and expect Bitcoin to drift to the area around $24,000 in the short/medium term (though beyond that, we still stick to the main scenario we have been warning about for the entire bear market rally, which is Bitcoin revisiting its last year’s lows). To support this case, we want to see Bitcoin drop below $26,000. In addition to that, we want to see technical indicators, including RSI, MACD, and Stochastic, continue declining on the daily time frame. On top of that, we also want to see ADX start rising, which would suggest that a bearish trend is growing in strength.

In the coming days, we will pay attention to the stock market, which has been struggling to make new highs recently and whose weakness can have negative implications for Bitcoin. Considering that the tech sector was highly correlated with Bitcoin last year, we think there is a high chance that a positive correlation between the two assets will rise again (and the tech sector will drag down Bitcoin and the rest of the cryptocurrencies). We will update thoughts on the asset with the emergence of new developments.

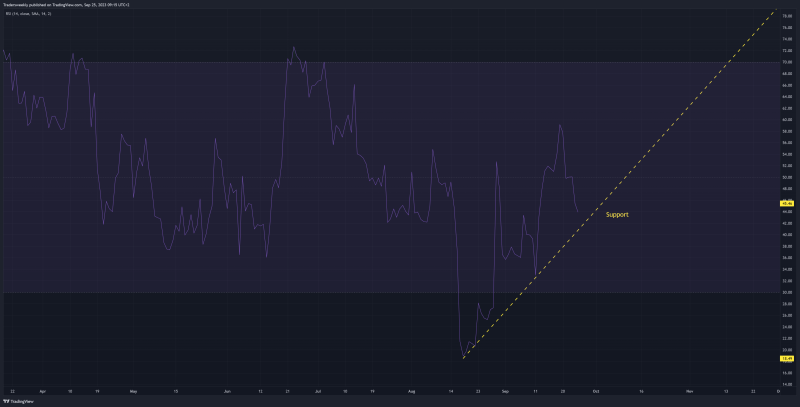

Illustration 1.01

Illustration 1.01 displays the daily chart of RSI. To support a bearish case, we want to see RSI break below the Support.

Illustration 1.02

Illustration 1.02 shows the daily chart of MACD. The yellow arrow indicates MACD’s failure to fully enter a bullish area above the midpoint. That is a bearish development.

Technical analysis gauge

Daily time frame = Bearish

Weekly time frame = Bearish

*The gauge does not necessarily indicate where the market will head. Instead, it reflects the constellation of RSI, MACD, Stochastic, DM+-, ADX, and moving averages.

Please feel free to express your ideas and thoughts in the comment section.

DISCLAIMER: This analysis is not intended to encourage any buying or selling of any particular securities. Furthermore, it should not be a basis for taking any trade action by an individual investor. Therefore, your own due diligence is highly advised before entering a trade.