Dogecoin does not have the best price trends, but certain wallets do not seem to care about what’s going on.

Edited By: Saman Waris

- DOGE has slipped into a bear trend.

- Whale accumulation has increased despite the negative price trend.

Despite a recent downward trend in Dogecoin’s [DOGE] price, there’s an interesting counter-activity observed among large investors or whale wallets.

These whale wallets have been actively accumulating significant volumes of DOGE in the past few days.

Dogecoin whales step up accumulation

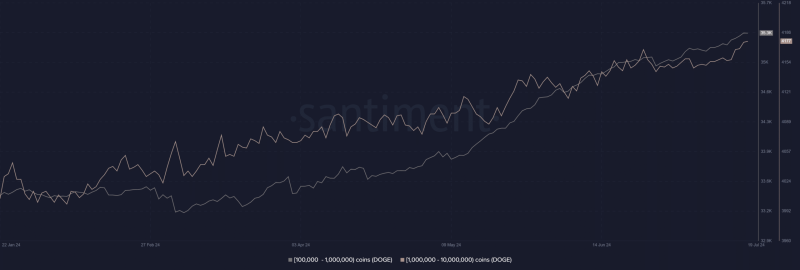

AMBCrypto’s analysis of Dogecoin wallets on Santiment revealed some intriguing activity among holders, particularly in the middle to upper tiers of holdings.

Specifically, wallets holding between 100,000 and 10 million DOGE have been actively accumulating more tokens over the last few days.

Analysis showed that wallets holding between 100,000 and 1 million DOGE have maintained their numbers in the 35,000 range but have seen a slight increase.

Also, the number of wallets holding between 1 million to 10 million DOGE is around 4,177.

There has been a slight increase in this category as well, suggesting that more significant investors are also showing renewed interest or increasing their stakes.

These wallets have collectively added over 60 million DOGE to their holdings in just the last 24 hours.

This substantial accumulation underscores a bullish sentiment among larger Dogecoin holders despite any negative trends in the broader market.

Dogecoin’s decline continues

AMBCrypto’s recent analysis of Dogecoin revealed that while there was notable accumulation by whale wallets, its price was on a decline.

Over the past four days, DOGE has consistently trended downward. As of this writing, it was trading at around $0.11, with a 0.6% decline in the latest session.

This followed a more substantial drop of over 1.8% in the previous session, where it fell from around $0.12 to $0.11.

This pattern of consecutive declines over four days is in contrast to the observed accumulation activity, indicating a divergence between investor actions and market price movements.

Additionally, the Relative Strength Index (RSI) suggested a weakening in the bullish momentum.

As of this writing, the DOGE’s RSI was below the neutral line, indicating a shift towards a bearish sentiment among traders.

Read Dogecoin’s [DOGE] Price Prediction 2024-25

Where this leaves DOGE

The whale wallet accumulations, despite the downward price trend in Dogecoin, suggested that large investors were bullish.

Their increased buying activity during a downtrend might be a calculated move, betting that the market will rebound, allowing them to profit from these lower-priced acquisitions.