Contents

Balancer is a DeFi project built on Ethereum that allows users to trade Ethereum-based tokens quickly and at some of the best rates available on the market. In addition to trading, Balancer can also be used to create a portfolio of crypto assets that’s rebalanced algorithmically and even earns fees for the investor.

Balancer is one of the most popular DeFi protocols out there. According to DeFi Pulse, it’s currently the 11th largest DeFi protocol on the Ethereum blockchain, and has a total value locked (TVL) of about $2.06 billion at the time of writing.

Balancer V2, the first big upgrade to the Balancer protocol, went live in May of 2021. This upgrade made Balancer much more efficient in terms of fees, as it introduced a Vault that manages all of the tokens in each Balancer pool.

Even more recently, the Balancer Labs team unveiled a collaboration with Gnosis, a renowned project in the Ethereum ecosystem. Their work together resulted in the Balancer-Gnosis Protocol, which brings some important improvements to Balancer. We’ll touch on this collaboration a bit further down in the article.

Who created Balancer and when?

The Balancer project started in early 2018 with the idea of expanding the use cases for automated makers (AMMs). The Balancer protocol itself was launched in March 2020, and the timing of the launch was very fortunate – just a few short months after, the DeFi space started displaying parabolic growth in what’s now known as the “DeFi Summer” of 2020. The main contributor to the Balancer project is Balancer Labs, which is headed by CEO and co-founder Fernando Martinelli.

What can you do with Balancer?

Before we continue, we should clarify one thing that sometimes confuses DeFi users. When it comes to DeFi, it’s important to keep in mind that the protocols themselves and the interfaces that people are using are two different things.

For example, app.uniswap.org is not the same thing as the Uniswap protocol. Uniswap is a protocol that’s deployed in the form of smart contracts on the Ethereum protocol, while app.uniswap.org is an interface that allows users to interact with the Uniswap protocol. Other people can build their own interfaces for accessing the same protocol.

The same concept applies to the Balancer protocol and the app.balancer.fi interface. In this review, we’ll be using the app.balancer.fi interface as an example, as it’s the most commonly used interface for Balancer and is kept up to date by the Balancer Labs team, which is the main contributor to the Balancer protocol itself.

The entirety of Balancer is built on the Ethereum blockchain. As long as you have some tokens and enough ETH to cover gas fees, you can use Balancer from anywhere in the world at any time you want.

Invest in a portfolio of crypto assets

Through its Pools feature, Balancer provides a decentralized way of creating a portfolio of crypto assets on the Ethereum blockchain or investing in a portfolio created by someone else. In some ways, this feature provides similar utility to an investment fund. However, unlike with traditional investment funds where the investor has to pay management fees to the fund’s issuer, Balancer actually rewards users for providing their capital.

Balancer’s pools provide a huge amount of flexibility. Balancer supports six different types of pools:

- Weighted pools

- Stable Pools

- MetaStable Pools

- Liquidity Bootstrapping Pools

- Managed Pools

- Custom Pools

The different pool types differ by the amount of different tokens they can contain, and use different underlying equations that are tailored for different use cases.

Traders can draw liquidity from these pools to perform token swaps. However, they need to pay a fee to perform the swap, which is distributed to the users that invested into the pools. In this way, users who invest in Balancer pools get exposure to the assets contained in the pool, and also earn extra trading fees on top.

When a Balancer pool is created, the creator determines the assets that will be included in the pool, and the weight that each asset will have. The pool is then rebalanced to meet these parameters when traders are using the pool’s liquidity to make swaps.

For example, if we have a pool that contains 50% ETH, 25% DAI and 25% BAL, and the price of ETH increases at a much faster pace than the price of DAI and BAL, the amount of ETH held by the pool will be reduced until it constitutes 50% of the pool again.

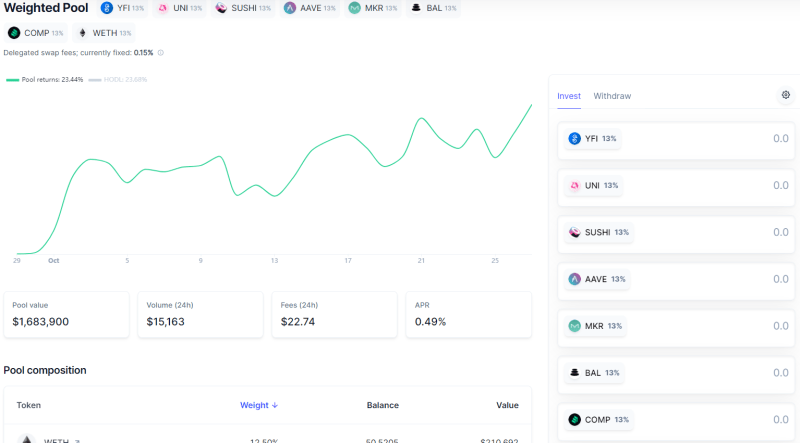

Let’s take a look at an example. This pool fully leverages the capabilities of Balancer’s weighted pools, as it contains the maximum number of tokens that are supported by this pool type (8 tokens). It’s designed to contain an equal split of 7 different DeFi protocol tokens, plus wrapped Ethereum. Each token has a 12.5% weight in the pool. Investing in this pool provides exposure to the DeFi ecosystem.

Here’s how Balancer Labs CEO Fernando Martinelli summed up Balancer’s utility in an article for Gemini’s Cryptopedia:

“By realigning incentives and removing intermediaries from top to bottom, the Balancer crypto platform has taken a cornerstone of traditional finance — index funds — and automated, democratized, and decentralized the concept into a wholly novel apparatus that creates remarkable value for its stakeholders.”

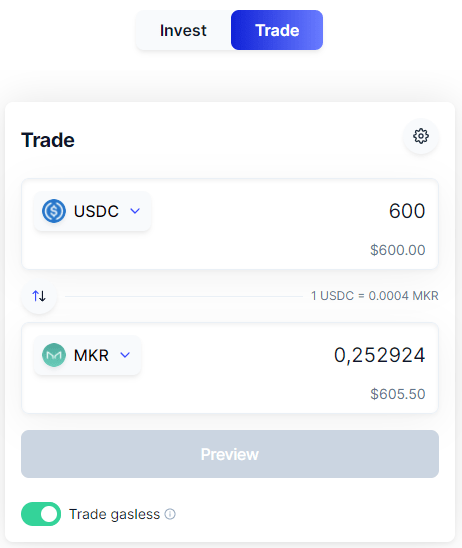

Trade tokens on-chain

As we’ve just mentioned, the Balancer protocol also serves traders, which can perform swaps thanks to the liquidity of Balancer’s pools. You can use Balancer as a decentralized exchange that provides a similar utility to protocols like Uniswap, SushiSwap or Kyber Network.

Balancer will automatically look for the best rate it can provide for your token swap. This is done through the Smart Order Router, which is designed to find the best possible trade either by performing a swap in one Balancer pool, or using a combination of multiple pools.

Trading on Balancer provides you with all the benefits of trading on decentralized exchanges. All the operations are performed directly on the Ethereum blockchain, and trading is non-custodial. You don’t need to deposit your tokens to a wallet owned by someone else – you simply connect your wallet and you’re good to go.

The BAL token

Balancer has a token called BAL, which serves as the protocol’s governance token. Holders of the BAL token decide on important changes to the protocol such as adding new tokens and changing fee levels and other network parameters. BAL is being distributed through liquidity mining, where users of the Balancer protocol can earn BAL by providing liquidity to the protocol. The maximum supply of BAL is capped at 100 million tokens.

Balancer-Gnosis Protocol

As we’ve mentioned above, Balancer recently unveiled a collaboration with Gnosis, which resulted in the Balancer-Gnosis Protocol. This new protocol combines the Vault system of Balancer V2 with a price-finding mechanism developed by Gnosis. It introduces a number of improvements to trading on Balancer, such as MEV (miner-extractable value) protection and better prices. Thanks to the Balancer-Gnosis Protocol, users are also no longer charged gas fees if their transaction fails. The Balancer-Gnosis protocol is now the default option on the Balancer.fi interface, so users don’t have to make any manual changes to start taking advantage of its benefits.

MEV protection is an important aspect of the Balancer-Gnosis Protocol, as it helps even the playing field between regular traders and power users like miners. MEV is used to describe the value that Ethereum miners can extract during the process of block production thanks to their power to include transactions, exclude transactions, and reorder transactions. This allows miners to front-run profitable transactions, perform arbitrage and other strategies that ultimately result in a worse experience for users, who have to deal with increased slippage and worse trade execution. Flashbots estimates that there has been $737.7 million in extracted MEV since January 1, 2020.

Summing up

Balancer has earned its spot as one of the pillars of the decentralized finance ecosystem, and provides unique opportunities to both investors with a longer-term outlook and traders who are constantly on the hunt for profitable moves. While Balancer is primarily known for its multi-asset liquidity pools which bring the concept of traditional investment funds to DeFi, it’s also worth keeping an eye on the new Balancer-Gnosis Protocol, which introduces big improvements to the trading side of the protocol.